Zelle®

4.1 Finance Updated January 7th, 2026

If you’ve ever found yourself in a pinch needing to pay someone back or split a bill, you’ll know the hassle of dealing with cash or checks. Enter Zelle, a nifty app that has revolutionized the way we handle money transfers. With just a few taps, you can send or receive money almost instantly. But is it really as good as it sounds? Let’s dive into it.

Getting Started with Zelle

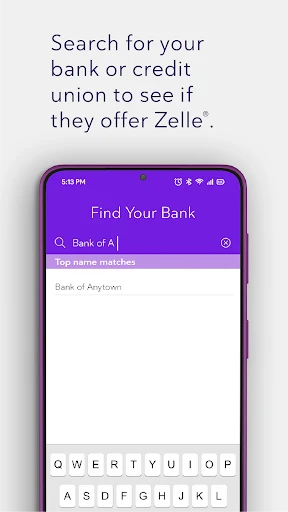

First things first, setting up Zelle is a breeze. If your bank or credit union offers Zelle, you can easily find it in your mobile banking app. No need to download anything extra! But if not, no worries—you can download the standalone Zelle app from the App Store or Google Play.

Once you’ve got it, linking your bank account is straightforward. Just a few steps and you're good to go. I found the whole process pretty intuitive, even for someone who's not particularly tech-savvy.

Using Zelle: Quick and Easy Transactions

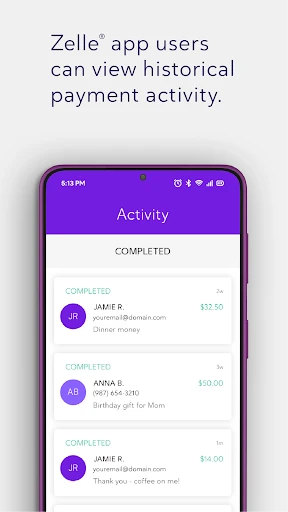

What really won me over with Zelle is its speed. Transactions are processed almost instantly, which is a huge step up from traditional bank transfers that can take days. All you need is the recipient's email address or phone number, and off your money goes.

I’ve used it to split dinner bills, pay for shared gifts, and even settle up rent with roommates. It’s like having a digital wallet that works seamlessly with your existing bank account. No need to worry about loading funds into an app or waiting for withdrawals.

Security: Is Your Money Safe?

Now, I know what you’re thinking. Is it safe to send money through an app? Zelle banks on the security of your existing bank account, using authentication and monitoring features to help protect users.

However, a word of caution: Zelle doesn’t offer buyer protection like some other payment services. So, only send money to people you trust. I learned this the hard way when I mistakenly transferred money to the wrong person and couldn’t get it back. Lesson learned!

What Could Be Better?

While Zelle is pretty fantastic, it’s not without its quirks. For one, it’s mostly available through banks and credit unions in the U.S. So, if you’re trying to send money internationally, you’ll have to look elsewhere.

Additionally, not every bank supports Zelle yet, which can be a bummer if your financial institution isn’t on board. And remember, no refunds or cancellations once the money is sent, so double-check those details before hitting send.

Overall, Zelle is a handy tool for quick and easy money transfers. It’s especially great for those who already have it integrated into their banking apps. Just remember to use it wisely and keep an eye on who you’re sending money to. Happy transferring!

Screenshots