PayPal - Pay, Send, Save

4.2 Finance Updated January 1st, 2026

If you've ever found yourself in a situation where you needed to send money to a friend or pay for something online, chances are, you've come across PayPal. It's like that reliable friend who's always got your back when you're short on cash. But is it really all it's cracked up to be? Let's dive in and see what this app is all about.

Getting Started with PayPal

First things first, setting up PayPal is a breeze. You download the app, sign up with your email, link your bank account or card, and voila, you're ready to roll. The user interface is clean and intuitive, so even if you're not tech-savvy, you won't feel lost. With just a few taps, you can send money, request payments, and even pay for purchases in-store using QR codes.

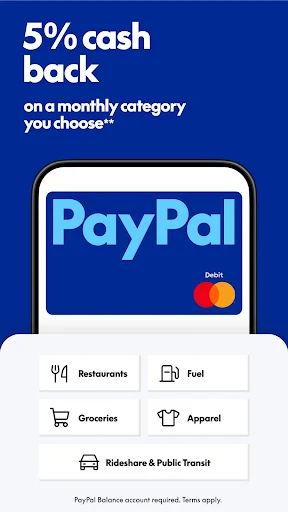

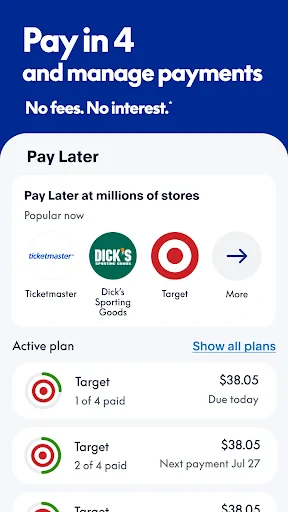

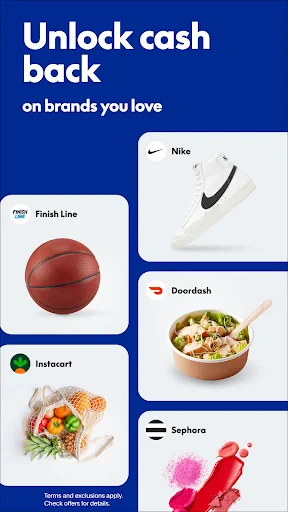

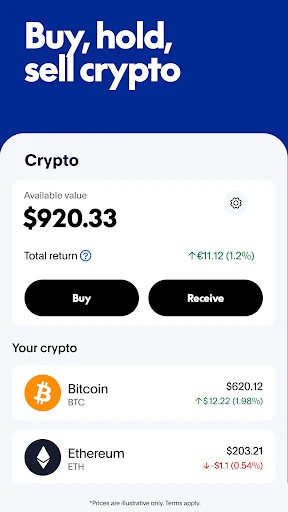

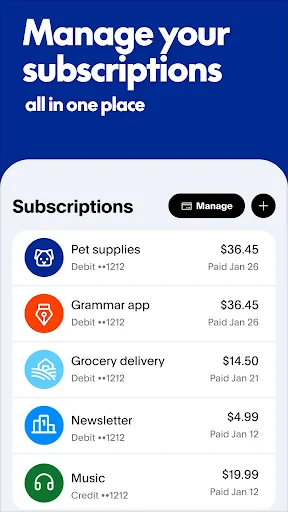

Features That Stand Out

One of the standout features of PayPal is its ability to send money internationally. Whether you're splitting the bill with friends overseas or paying for a service from another country, PayPal makes it easy. The app supports multiple currencies, and the exchange rates are pretty competitive.

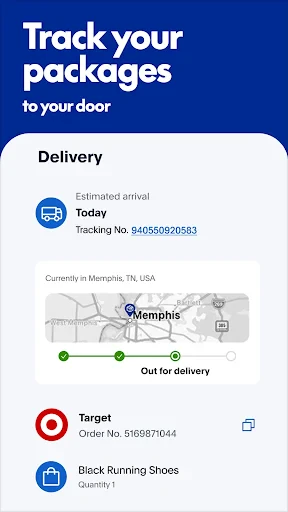

Another cool feature is PayPal's Buyer Protection. Ever bought something online and never received it? With PayPal, you can file a dispute, and they’ll have your back. It's like having a safety net for your online purchases.

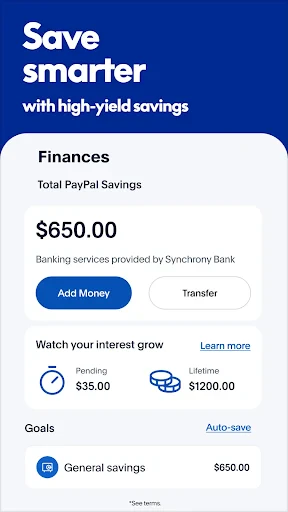

PayPal also offers a savings feature called PayPal Savings. It’s not going to replace your traditional bank savings account, but it’s a nice little addition for those who want to set aside some cash. You can track your savings goals right from the app, which is pretty nifty.

Security and Privacy

Security is a big deal when it comes to handling money online, and PayPal doesn’t disappoint. They’ve got top-notch encryption, and they monitor transactions 24/7 to prevent fraud. Plus, they don’t share your financial details with the merchants. It’s like having an invisible shield that keeps your financial info safe and sound.

For those who are extra cautious, PayPal offers two-factor authentication, adding an extra layer of security to your account. It’s like having a lock with two keys instead of one.

What Could Be Better?

While PayPal is pretty fantastic, it's not without its quirks. The fees can be a bit of a pain, especially if you're sending money internationally. And sometimes, the exchange rates aren’t as favorable as you'd like them to be.

There's also the issue of account limitations. If PayPal detects any suspicious activity, they might limit your account, which can be frustrating. It’s like being locked out of your own house because you forgot your keys.

One last thing, customer support can be hit or miss. Sometimes you get a helpful representative, other times you might feel like you're talking to a robot. It’s a bit of a gamble.

All in all, PayPal is a solid choice for managing your online transactions. It’s user-friendly, packed with features, and offers a level of security that gives you peace of mind. Just keep an eye on those fees and make sure your account stays in good standing. Happy transacting!

Screenshots