Venmo

4.1 Finance Updated January 1st, 2026

Have you ever found yourself in a situation where you need to pay your friend back for that pizza you shared last night, but you don’t have cash on you? Or maybe you need to split that Uber ride with your pals? Well, let me introduce you to Venmo, the app that’s got your back when it comes to easy and quick money transfers.

What is Venmo?

Picture this: Venmo is like your digital wallet, but way cooler. It’s a mobile payment service owned by PayPal, and it’s become super popular among the younger crowd. Why? Because it lets you send and receive money without any hassle. All you need is an internet connection, and you’re good to go. The app is available for both Android and iOS, so no one’s left out.

Getting Started with Venmo

Downloading Venmo is a breeze. Just head over to the Google Play Store or Apple’s App Store, hit that download button, and voilà, you’re ready to roll. Setting up an account is pretty straightforward too. You can sign up using your email address or phone number, and you’ll need to link a bank account or debit card to start sending money. Don’t worry; Venmo’s got top-notch security to keep your info safe.

The Venmo Experience

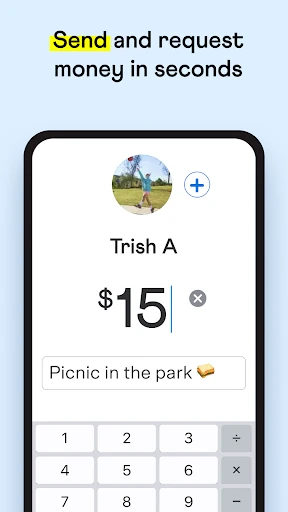

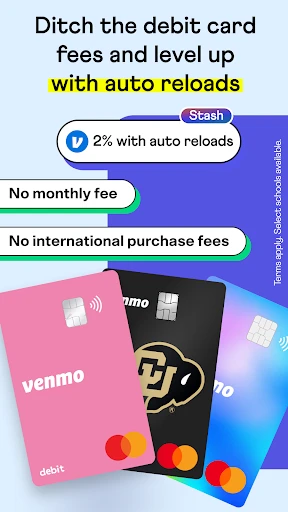

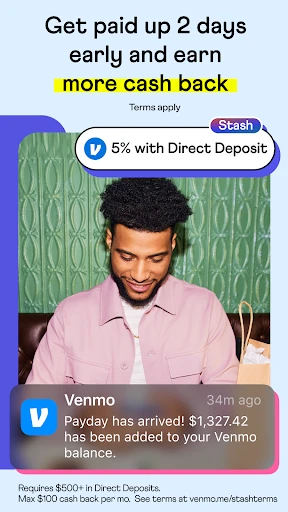

Once you’re all set up, using Venmo is as easy as pie. The interface is clean and user-friendly, so even if you’re not tech-savvy, you’ll find your way around in no time. You can send money to anyone with a Venmo account, and the best part? It’s free if you’re using your Venmo balance, bank account, or debit card. If you’re in a rush and need to use a credit card, there’s a small fee, but hey, convenience comes at a price, right?

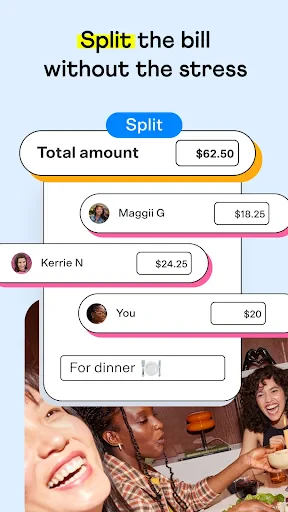

Oh, and did I mention the social aspect? Venmo has this cool feature where you can add notes or emojis to your transactions. It’s like a mini social feed where you can see what your friends are up to. Don’t worry; you can keep your transactions private if you’re not into sharing everything with the world.

Is Venmo Right for You?

So, is Venmo the app for you? Well, if you’re someone who loves convenience and hates dealing with cash, then absolutely. It’s perfect for splitting bills, paying rent, or just sending a quick birthday gift to a friend. Plus, with its strong community vibe, it adds a fun twist to the mundane task of transferring money.

However, it’s worth noting that Venmo is primarily used within the United States. So, if you’re planning on sending money internationally, you might want to look at other options. But for your everyday domestic transactions, Venmo’s got you covered.

In conclusion, Venmo is like that reliable friend who’s always there when you need them. It’s easy to use, secure, and brings a bit of fun to the world of mobile payments. So next time you find yourself in a cashless bind, give Venmo a try. Trust me; you’ll wonder how you ever lived without it!

Screenshots