Revolut: Spend, Save, Trade

4.5 Finance Updated January 1st, 2026

Have you ever found yourself juggling multiple banking apps just to get a handle on your finances? Well, let me introduce you to Revolut: Spend, Save, Trade. It's like having a financial Swiss Army knife right in your pocket. Whether you're looking to manage your daily expenses, save for a rainy day, or even dip your toes into trading, this app has got you covered.

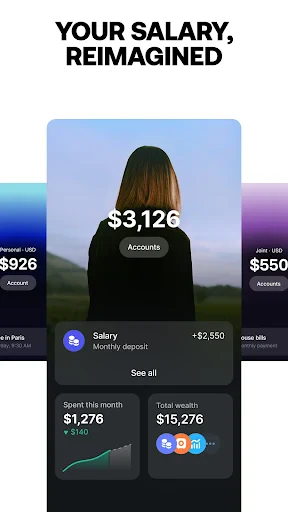

Seamless Financial Management at Your Fingertips

With Revolut, the days of cumbersome banking are over. One of the first things I noticed after installing it was how easy it was to set up. Within minutes, I had a sleek digital account ready to go. The app’s interface is clean and intuitive, making it a breeze to navigate through its myriad features.

One of my favorite features is the budgeting tool. It automatically categorizes your spending, giving you a clear visual of where your money is going. It's like having a personal financial advisor who doesn't charge an arm and a leg. Plus, you can set spending limits on different categories, helping you stay on track with your financial goals.

Saving and Spending: A Delicate Balance

We all know how important saving is, but let’s be real, it’s not always easy. Revolut makes it a bit more fun with their "Vaults" feature. You can round up your spare change from purchases and stash it away in a savings vault. It's an effortless way to build your savings without even thinking about it. You can also set up recurring transfers to your vaults, which means your savings grow automatically.

On the spending side, Revolut offers a unique feature where you can hold and exchange multiple currencies. Say goodbye to hefty exchange fees when traveling or shopping internationally. It’s a game-changer for those of us who love to globe-trot or shop across borders.

Dipping Your Toes into Trading

If you’ve ever been curious about trading but didn’t know where to start, Revolut offers a user-friendly platform for trading stocks and cryptocurrencies. It’s perfect for beginners like myself who want to get a taste of the trading world without diving in headfirst. The app provides real-time market data and allows you to buy fractions of shares, so you don’t need a massive bankroll to get started.

What’s more, Revolut also provides educational resources to help you understand the market better. So, not only are you trading, but you’re also learning – a win-win, if you ask me!

Conclusion: Is Revolut Right for You?

In a world where financial literacy is more important than ever, an app like Revolut can be incredibly empowering. It combines spending, saving, and trading into one easy-to-use platform that fits right into our fast-paced lives. Whether you're a seasoned traveler, a budding trader, or someone just looking to get a better grip on your finances, Revolut has something to offer.

So, if you’re ready to take control of your financial future, why not give Revolut: Spend, Save, Trade a try? It might just be the financial tool you didn’t know you needed.

Screenshots