Cash App

4.7 Finance Updated January 1st, 2026

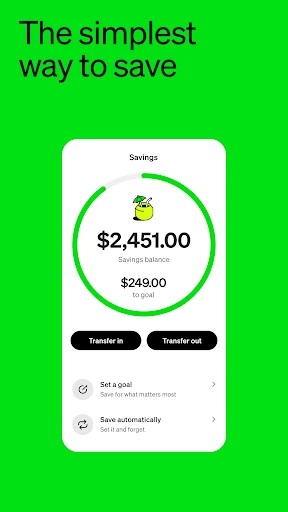

Let's dive into the world of Cash App, a mobile payment service that's been making waves in the financial tech scene. If you're tired of traditional banking or just want a more flexible way to manage your money, Cash App might just be your new best friend. Here's my take on it after giving it a whirl.

Getting Started with Cash App

First things first, downloading and setting up Cash App is a breeze. Available on both Android and iOS, you just need to head over to your app store and get it installed. Once you've got it on your device, the registration process is straightforward. You simply input your details, link your debit card, and voila, you're ready to start sending and receiving money. I appreciate that Cash App doesn't bombard you with endless forms or unnecessary steps. It's all about getting you up and running quickly.

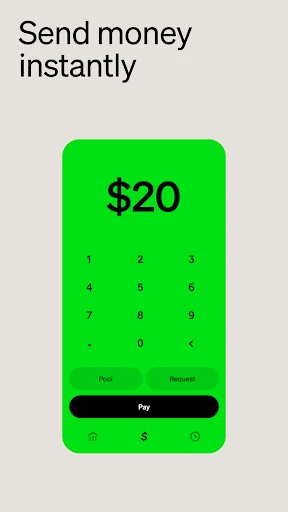

Simplifying Money Transfers

Cash App excels in the simplicity and speed of peer-to-peer payments. Whether you're splitting a dinner bill, paying rent, or just sending money as a gift, Cash App makes the process seamless. You only need the recipient's email or phone number tied to their account, and with just a few taps, the money is on its way. It's this ease of use that makes Cash App particularly appealing to those of us who aren't tech-savvy.

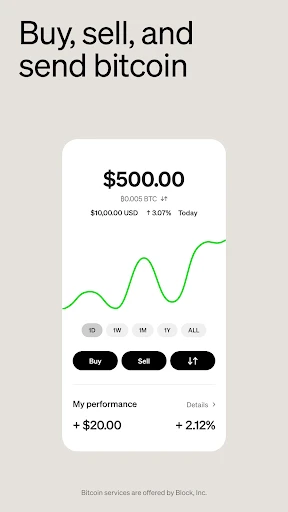

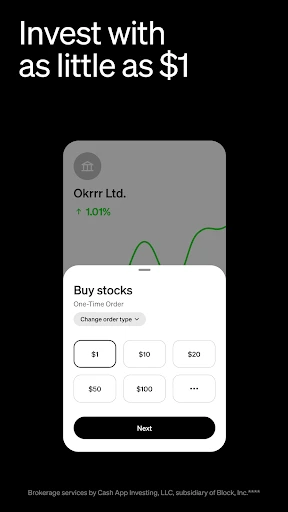

Investing with Cash App

One of the standout features is the ability to invest in stocks and Bitcoin directly through the app. You don't need to be a Wall Street wizard to start investing; Cash App breaks it down into digestible bits. You can buy fractional shares, which means you can invest as little or as much as you want. Bitcoin enthusiasts will also appreciate the option to buy, sell, and store Bitcoin right within the app. It's a nifty feature for anyone looking to dabble in the stock market or cryptocurrency without the hassle.

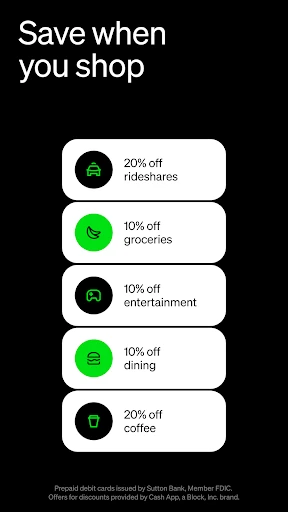

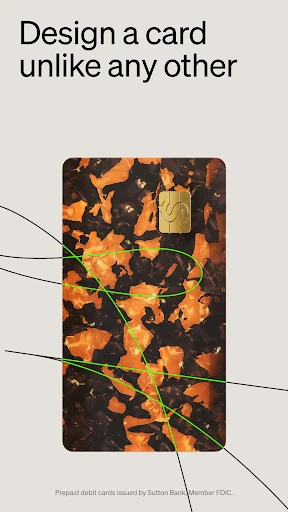

Cash Card and Boosts

The Cash Card is another cool feature worth mentioning. It's a customizable Visa debit card that you can use to spend your Cash App balance anywhere Visa is accepted. Plus, Cash App offers "Boosts," which are instant discounts at certain retailers and restaurants when you use your Cash Card. I found this feature particularly useful, as saving a few bucks here and there never hurts.

Security and Peace of Mind

When it comes to handling money, security is paramount. Cash App uses encryption and fraud detection technology to keep your funds safe. Plus, you can set up a PIN or use your fingerprint to authorize payments, adding an extra layer of protection. It's reassuring to know that the app takes your security seriously while providing such convenience.

In conclusion, Cash App offers a user-friendly and versatile platform for managing your money. Whether you're sending cash, investing, or using the Cash Card, the app delivers on its promise of simplicity and convenience. It's a great tool for anyone looking to break away from traditional banking constraints. Give it a shot and see how it fits into your financial routine.

Screenshots