Intuit Credit Karma

4.7 Finance Updated January 1st, 2026

Ever thought about how cool it would be to have a personal finance guru in your pocket? Well, that’s exactly what Intuit Credit Karma aims to be. I recently took a deep dive into this app, trying to see if it could actually help me get my financial life in order, and here’s what I found.

First Impressions Matter

Right off the bat, opening the Intuit Credit Karma app feels like stepping into a modern finance hub. The interface is slick, clean, and super user-friendly. You know how some apps make you feel like you're stranded in a jungle of buttons and options? Not this one! Everything is laid out where you’d expect it to be, making navigation a breeze even for finance newbies like me.

Tracking Credit Scores Like a Pro

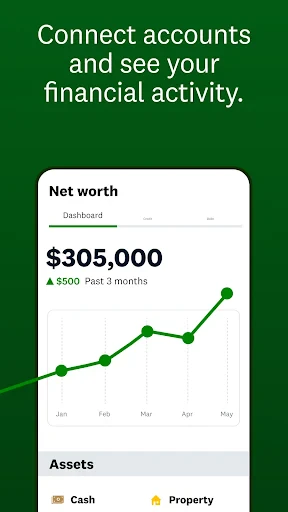

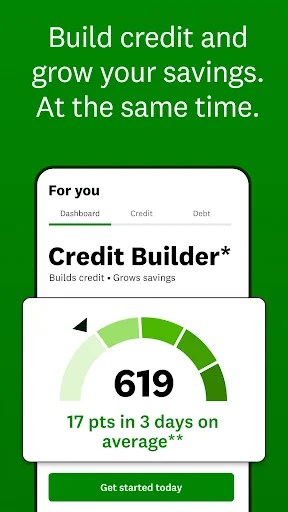

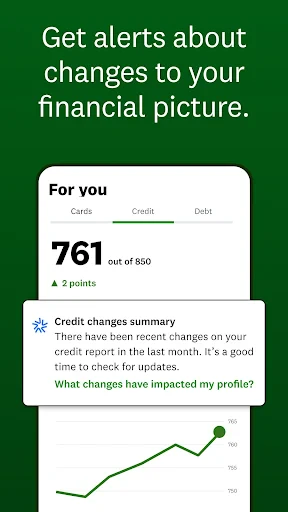

One of the main features of Intuit Credit Karma is its ability to track credit scores. I was a bit skeptical at first – like, can an app really keep up with the complexities of credit scores? Turns out, it can! The app provides free access to your credit scores and reports, updating weekly so you’re always in the loop. It’s like having a little financial guardian angel watching over your shoulder.

What’s even better is the detailed breakdown it offers. You get insights into what factors are affecting your score and tips on how to improve it. It’s like a mini financial education every time you log in. Plus, it doesn’t hurt that all this comes free of charge, because who doesn’t love free stuff?

Beyond Just Credit Scores

But wait, there’s more! Intuit Credit Karma isn’t just about keeping tabs on your credit score. It also helps you with tax filing, loan shopping, and even offers personalized recommendations to save you money. I tried out the tax filing feature last tax season, and it was surprisingly painless. The app walks you through the process step by step, ensuring you don’t miss out on any deductions.

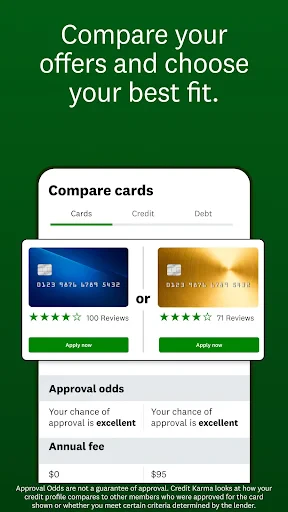

Another handy feature is the personalized loan and credit card offers. The app analyzes your credit profile and suggests options that might suit your financial situation. I found this particularly useful because it takes the guesswork out of choosing the right financial products.

Security You Can Trust

Now, I know what you’re thinking – all these features sound great, but what about security? Intuit Credit Karma has got you covered. The app uses bank-level encryption to protect your data, which definitely puts my mind at ease. It’s reassuring to know that even though I’m accessing sensitive financial information, it’s all locked up tight.

So, would I recommend Intuit Credit Karma? Absolutely. Whether you’re a finance rookie trying to get your bearings or a seasoned pro looking for a handy tool to keep everything in check, this app has something for you. It’s like a financial Swiss army knife – versatile, reliable, and always there when you need it.

Screenshots