Wise: International Transfers

4.7 Finance Updated January 7th, 2026

The world feels like a smaller place thanks to apps like Wise: International Transfers. Whether you’re a frequent traveler, an expat, or just someone who loves to send money abroad, this app might just become your best friend. Let me take you through my experience with it.

Why Wise Stands Out

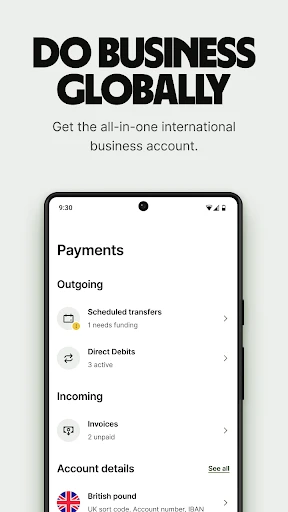

So, what sets Wise: International Transfers apart from the crowd? For starters, it’s all about transparency and savings. Unlike traditional banks, which often sneak in hidden fees and unfavorable exchange rates, Wise offers real exchange rates with a small upfront fee. And trust me, those pennies saved add up over time!

A User-Friendly Experience

Getting started on Wise was a breeze. After downloading the app, setting up an account was straightforward. The interface is intuitive, making it easy even for someone who's not particularly tech-savvy. I particularly appreciated the step-by-step guide that walked me through my first transfer. No hiccups, just smooth sailing!

Speed and Efficiency

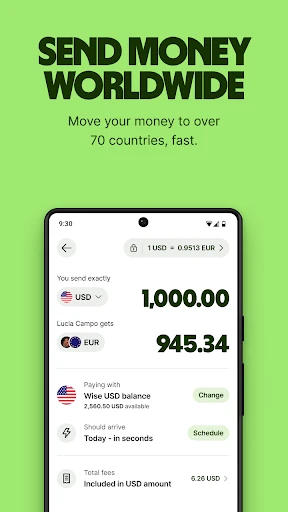

Another thing I love about Wise is its speed. Transfers that typically take days with traditional banks were completed in mere hours. Once, I urgently needed to send money to a friend overseas, and Wise came through like a charm. It’s like having a personal bank in your pocket, minus the long lines and paperwork.

Safety First

Security is a big deal when it comes to money, and Wise doesn’t skimp on that front. The app uses advanced security measures to ensure your funds and data remain protected. Plus, with real-time notifications, you’re always in the loop about where your money is.

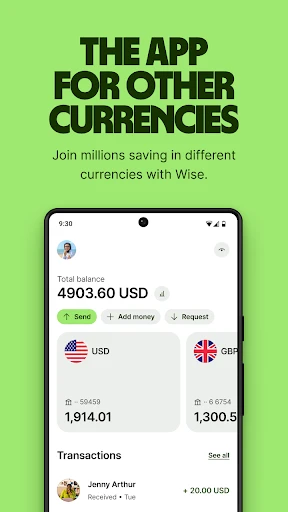

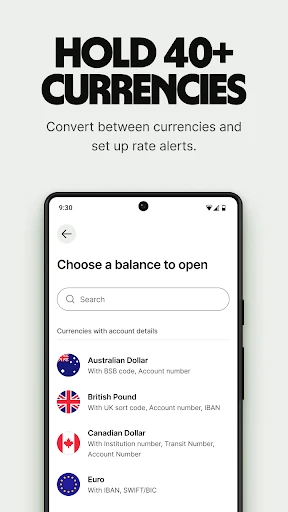

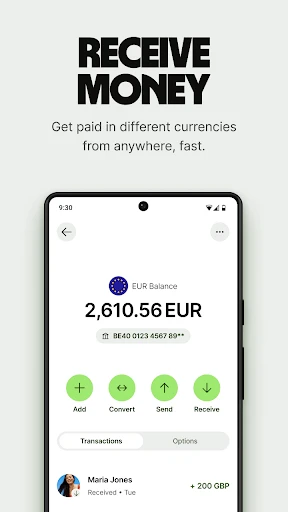

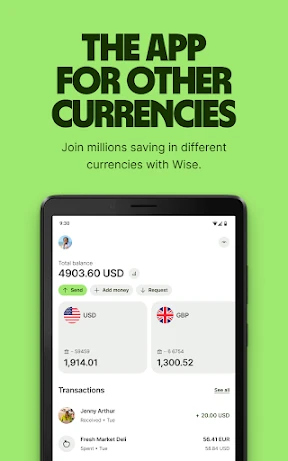

And here’s a little pro tip: Wise also offers a multi-currency account, which means you can hold and manage money in more than 50 currencies. Perfect for those who deal with multiple currencies regularly.

Final Thoughts

All in all, Wise has truly revolutionized the way I handle international transactions. It’s not just about sending money; it’s about doing it smartly, efficiently, and safely. If you’re tired of being at the mercy of traditional banks and their high fees, give Wise a shot. It’s an app that delivers on its promises and makes international transfers a breeze.

Screenshots