Walmart MoneyCard

4.1 Finance Updated January 7th, 2026

When it comes to managing your finances, especially in a world full of digital transactions, the Walmart MoneyCard app becomes a handy companion. I’ve spent some time exploring this app, and let me tell you, it’s like having a mini bank in your pocket.

Getting Started with Convenience

The first thing you’ll notice about the Walmart MoneyCard app is its straightforward setup process. Downloading and installing it is a breeze, and before you know it, you’re ready to dive into the world of digital financial management. The app’s user-friendly interface makes navigating through features feel like a walk in the park. It’s perfect for someone like me who sometimes struggles with overly complex apps.

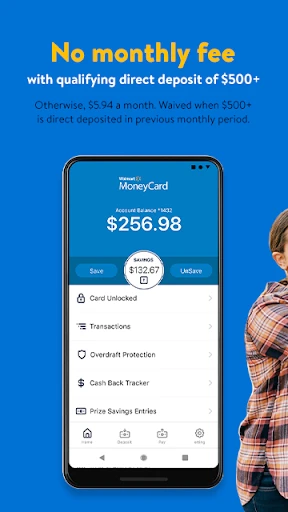

Once you’re in, linking your card and accounts is seamless. The app guides you through the process, ensuring you’re all set to manage your funds efficiently. I loved how I could monitor my spending in real-time, which is a big plus if you’re keen on keeping your budget in check. Plus, the ability to deposit checks and pay bills directly from the app saves a lot of hassle.

Features That Stand Out

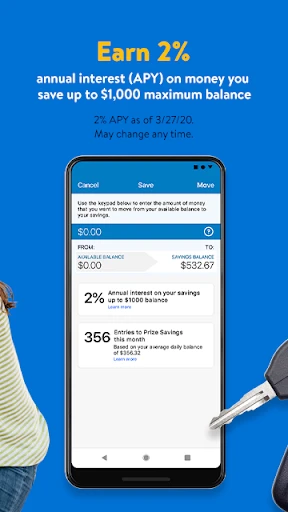

One of the standout features of the app is its cashback rewards program. Who doesn’t love getting rewarded for shopping? As you make purchases, you earn cashback, which you can use for future shopping sprees at Walmart. It’s like the app is encouraging you to treat yourself while saving a bit on the side.

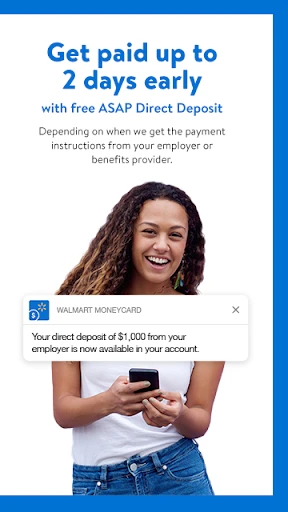

Another feature that caught my eye is the early direct deposit. Imagine getting your paycheck up to two days earlier than usual. It’s a lifesaver, especially when you have bills to pay or weekend plans that need funding. Plus, the app provides free cash withdrawals at Walmart locations, which adds to the convenience factor.

Security and Reliability

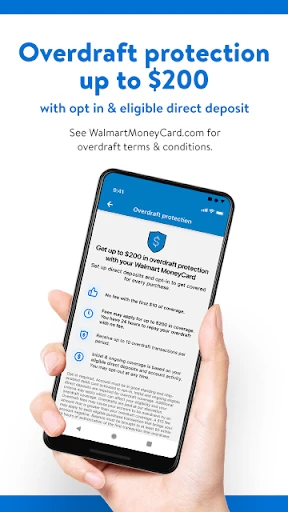

In today’s digital age, security is paramount, and the Walmart MoneyCard app doesn’t disappoint. It offers robust security measures, including instant locking options for your card if it gets lost or stolen. This feature gives you peace of mind, knowing your finances are protected even in unfortunate situations.

The app also sends real-time alerts for transactions, which is great for keeping tabs on your spending. I appreciate the transparency it provides, making sure that every penny is accounted for and nothing slips through the cracks.

Final Thoughts

All in all, the Walmart MoneyCard app is a solid choice for anyone looking to manage their finances efficiently. It combines convenience with a suite of features that are tailored to make your financial life easier. While it may not replace your traditional bank account, it certainly complements it by providing easy access to your money with some added perks.

So, if you’re on the hunt for a financial app that offers reliability, security, and a few rewards along the way, give the Walmart MoneyCard app a try. It might just become your new financial sidekick!

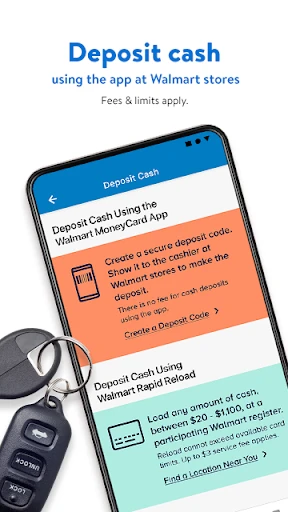

Screenshots