Varo Bank: Online Banking

4.6 Finance Updated January 7th, 2026

Hey there, fellow money managers! Let me spill the beans about an app that's shaking up the banking world – Varo Bank: Mobile Banking. If you're tired of the same old brick-and-mortar bank drama, you might want to give this a whirl. Here’s why this digital banking buddy is turning heads.

Why Varo Bank is Worth Your Attention

First things first, Varo Bank isn’t your traditional bank. There are no physical branches, which means everything is at your fingertips. No more racing against the clock to make it to the bank before it closes. Instead, you have 24/7 access right from your phone. Talk about convenience!

Getting Started with Varo Bank

Signing up is a breeze. You download the app, fill in some basic info, and voila! You’re in. The interface is sleek and user-friendly, which makes navigation super easy, even if you’re not tech-savvy. It’s like having a personal banker in your pocket.

Features That Stand Out

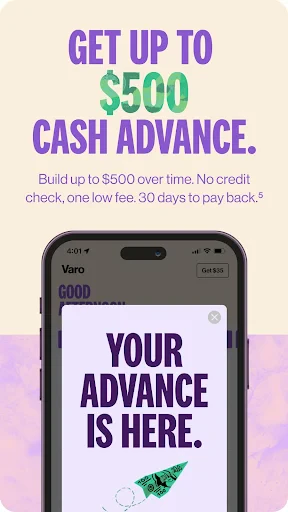

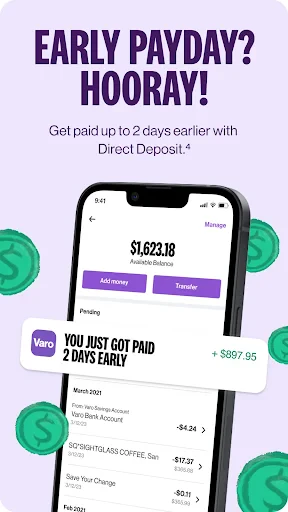

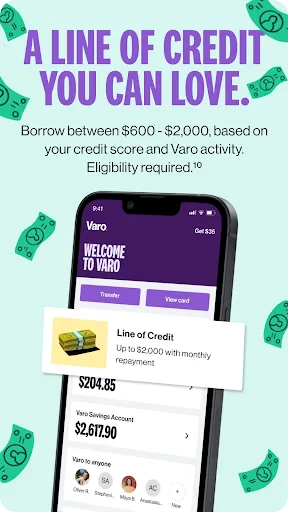

Varo Bank offers a bunch of nifty features that make managing your finances a walk in the park. You get early access to your paycheck, which is a lifesaver if you’re living paycheck to paycheck. Plus, there are no monthly maintenance fees or overdraft fees, which is a huge relief.

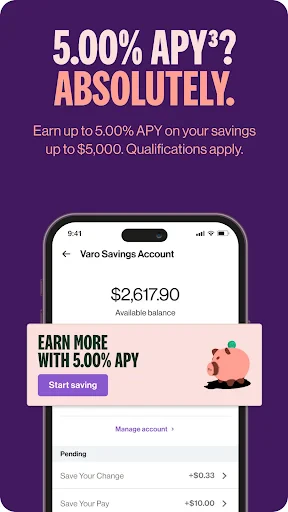

Need to save up for that dream vacation or a new gadget? Varo’s got your back with its automatic savings tools. You can set up savings goals, and the app will help you stash away some cash without you even noticing. It’s like having a sneaky little savings elf.

Security and Support

Now, I know what you’re thinking. Is it safe? Absolutely! Varo Bank uses top-notch encryption to keep your money and personal info secure. If you ever run into any issues, their customer support team is just a tap away, ready to help you out. No more waiting on hold for hours.

Final Thoughts

All in all, Varo Bank: Mobile Banking is a solid choice if you’re looking for a modern banking experience without the hassle of traditional banks. It’s perfect for those who want to manage their money effortlessly and securely, without all the extra fees. So, if you’re ready to ditch the bank lines and embrace the future of banking, give Varo Bank a shot. You might just find it’s the banking revolution you’ve been waiting for!

Screenshots