SoLo Funds: Lend & Borrow

4.2 Finance Updated January 7th, 2026

Ever find yourself short on cash just days before payday? Don't worry, you're not alone. Enter SoLo Funds: Lend & Borrow, the app that’s designed to be your financial buddy in times of need. I’ve taken it for a spin, and here’s what I think.

What is SoLo Funds All About?

Picture this: an emergency pops up, and you’re in need of a quick loan without the hassle of paperwork or high-interest rates. SoLo Funds swoops in to save the day. It’s a peer-to-peer lending platform where you, yes you, can either lend or borrow money. The beauty of it? It’s all community-driven!

Getting Started

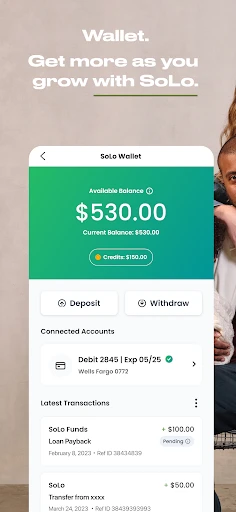

Setting up the app is a breeze. Once downloaded, you sign up with your basic info and connect your bank account. Don't worry, the app uses bank-level security to keep your data safe. I felt like a financial whiz as I navigated through the sleek and intuitive interface.

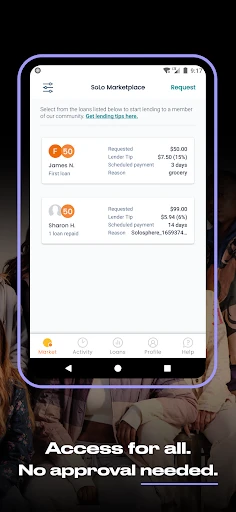

Lending Made Easy

If you’ve got some extra cash lying around, why not help someone out and earn a small return? With SoLo Funds, you can browse through borrowing requests and choose whom you’d like to lend to. You get to set the terms, and the app handles all the nitty-gritty details.

Borrowing When You’re in a Pinch

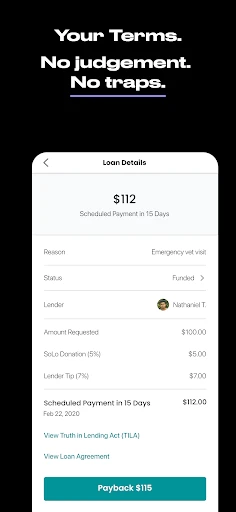

We’ve all been there – unexpected expenses can throw a wrench in our plans. With SoLo Funds, applying for a loan is quick and straightforward. You just post your request, and lenders in the community can choose to help you out. It’s like having a financial safety net, and honestly, it’s a relief to know it’s there.

Community and Transparency

One thing I really appreciate about SoLo Funds is the emphasis on community. You’re not just another faceless borrower or lender; you’re part of a network. Plus, the app is clear about fees and terms, so there are no nasty surprises down the line. Transparency for the win!

SoLo Funds: Lend & Borrow is more than just an app; it’s a financial community. Whether you’re looking to lend some spare dollars or need a quick financial boost, it’s got your back. I’d say give it a whirl and see how it can fit into your financial strategy.

Screenshots