SoFi - Banking & Investing

4.0 Finance Updated January 7th, 2026

If you’ve been on the hunt for an all-in-one financial app that can handle everything from banking to investing, you might want to give SoFi a whirl. I’ve been playing around with it for a bit, and let me tell you, it’s like having your own personal finance hub right at your fingertips. Let’s dive into what makes SoFi tick and see if it’s the right fit for you.

Getting Started with SoFi

So, first things first, setting up SoFi is a breeze. You just download the app, sign up, and voilà, you’re in. The user interface is super sleek and intuitive, making it easy for anyone to navigate, even if you’re not a tech wizard. I love how everything is laid out – it’s like the app knows me better than I know myself. Whether you’re checking your account balances or planning your next big investment move, it’s all right there, front and center.

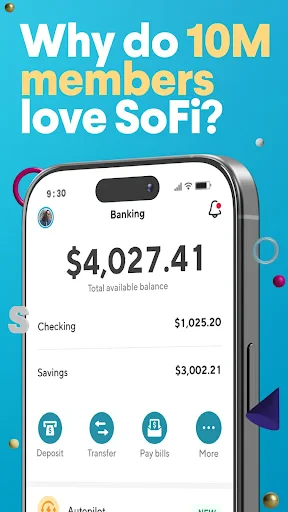

Banking Features

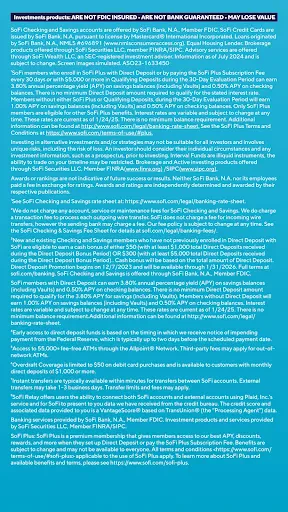

Now, let’s talk banking. SoFi offers a range of banking services that rival traditional banks. You’ve got your checking and savings accounts, and the best part? No account fees. Seriously, who doesn’t love saving a few bucks? Plus, they offer competitive interest rates on savings, which means more money in your pocket without lifting a finger. And don’t even get me started on the SoFi debit card – it’s accepted everywhere and comes with some nifty cash-back rewards.

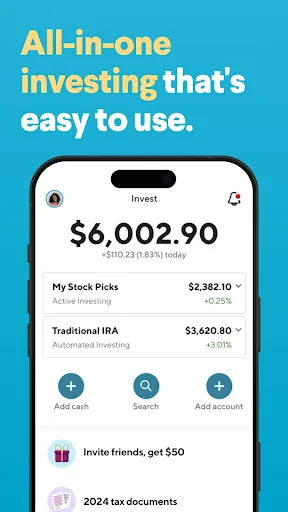

Investing Made Easy

On the investing side, SoFi really shines. It doesn’t matter if you’re a seasoned investor or just getting your feet wet, SoFi has something for everyone. They offer a wide array of investment options, from stocks and ETFs to crypto. What’s cool is that they also provide automated investing, which is perfect if you’re like me and prefer to set it and forget it. Plus, they offer educational resources that are super helpful if you’re trying to up your investing game.

Additional Perks

Aside from the banking and investing features, SoFi throws in some extra perks that make it stand out. For instance, they offer personal loans at competitive rates and even provide career coaching and financial planning. It’s like having a financial advisor in your pocket. And for all the student loan holders out there, SoFi offers refinancing options that can potentially save you a chunk of change.

Final Thoughts

So, is SoFi worth it? In my opinion, absolutely. It’s a robust app that caters to a wide range of financial needs, and it does so with style and efficiency. Whether you’re looking to manage your day-to-day finances, dive into investing, or need a little help with loans, SoFi’s got your back. It’s like having a mini financial powerhouse in your pocket. Give it a try and see how it can transform your financial life.

Screenshots