Skrill - Fast, secure payments

4.6 Finance Updated January 7th, 2026

So, I recently got my hands on Skrill, the app that's all about fast and secure payments, and I have to say, it’s been quite the ride. If you've ever been caught in the web of online transactions, you'll know how crucial it is to have a reliable service. Let's dive into the nitty-gritty of what makes Skrill a go-to app for so many.

Speedy Transactions at Your Fingertips

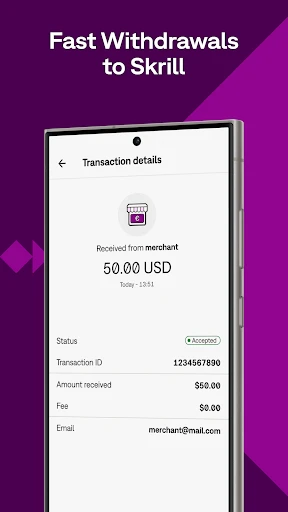

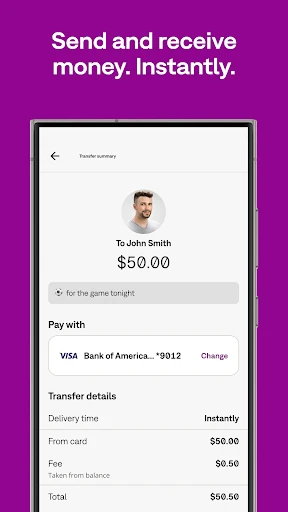

First things first, the speed. You know those moments when you're in a rush, and you need to send money ASAP? Well, Skrill has got your back. The app prides itself on making transactions quick and hassle-free. From sending money to friends and family to paying for services online, the process is seamless. I was particularly impressed with how swiftly it handled international transfers. No more waiting around for days on end.

Security That Gives Peace of Mind

Now, let's talk about security because, let's face it, that's what really matters when it comes to online payments. Skrill uses top-notch encryption to ensure your data is safe. I mean, who doesn’t want their money to be safe from prying eyes? The two-factor authentication adds an extra layer of security, which is always a win in my book. It's like having a digital vault in your pocket.

User-Friendly Interface

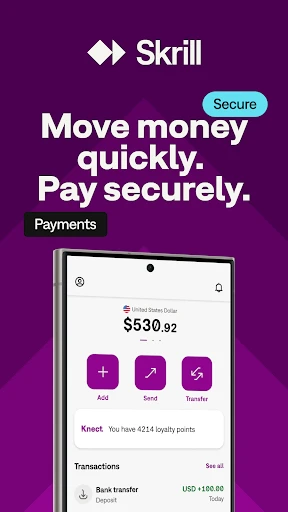

Another thing that stands out is the app's user-friendly interface. Even if you're not the most tech-savvy person, navigating through Skrill is a breeze. Everything is laid out in a clean and organized manner, making it easy to find what you need without any fuss. I found the process of setting up an account straightforward, and linking my bank account was a piece of cake.

One handy feature is the ability to track your spending. The app provides a detailed overview of your transactions, helping you manage your finances better. Plus, the notifications keep you updated on your account activity, so you're never in the dark.

Wide Range of Services

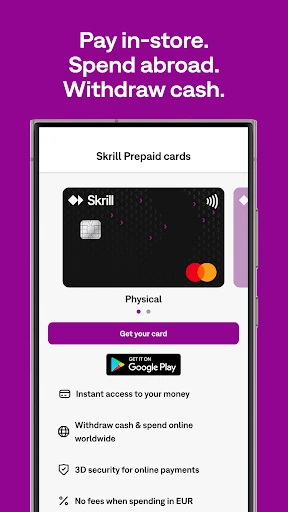

Skrill isn’t just about sending and receiving money. The app offers a plethora of services, including currency exchange, prepaid card services, and even cryptocurrency trading. Yes, you heard that right. If you're into crypto, Skrill allows you to buy and sell a variety of cryptocurrencies straight from the app. It’s like having a mini financial hub right in your pocket.

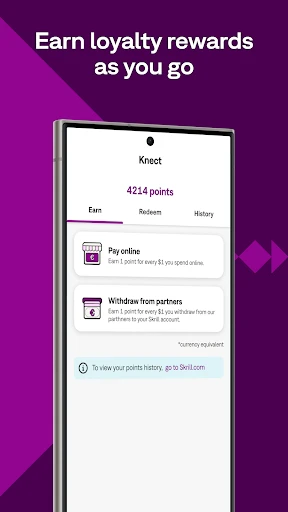

Another cool feature is the loyalty program. The more you use Skrill, the more rewards you can earn. It's a great incentive to keep using the app for your financial transactions, and who doesn’t love a little extra bonus?

Overall, Skrill is a solid choice for anyone looking to make online transactions easy, fast, and secure. While it might not be perfect for everyone, especially if you prefer sticking to traditional banking methods, it’s definitely worth a try if you’re looking for convenience and efficiency. So, whether you're a seasoned pro at online payments or a newbie just getting started, give Skrill a whirl and see how it fits into your digital lifestyle.

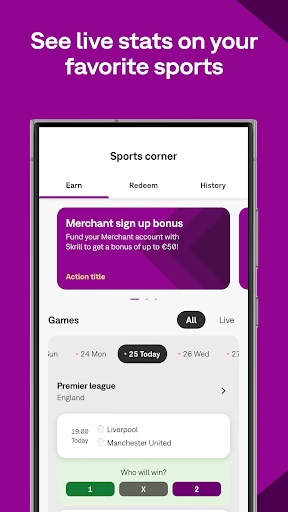

Screenshots