Robinhood - FinTech SuperApp

4.2 Finance Updated January 7th, 2026

Hey there! So, I recently got my hands on the Robinhood app, and let me tell you, it’s been quite an experience! If you’re like me, dabbling in investments and trying to make sense of the stock market, Robinhood is like that friendly guide you wish you had ages ago. Let's dive into what makes this app tick and whether it's worth your time.

Getting Started with Robinhood

First things first, setting up Robinhood is a breeze. I downloaded the app on my Android, but it’s available on iOS too. The signup process was straightforward, and within minutes, I was exploring the world of stocks, ETFs, and even cryptocurrencies. The app’s interface is sleek and user-friendly, which is a massive plus for someone who isn’t a Wall Street guru.

User Interface and Experience

The design of Robinhood is pretty minimalist, which I love. It doesn’t bombard you with unnecessary information or flashy ads. Instead, it focuses on providing a seamless user experience. Navigating through different sections like your portfolio, watchlist, and market news is smooth. The color scheme is also easy on the eyes, making it comfortable to use for extended periods.

Features That Stand Out

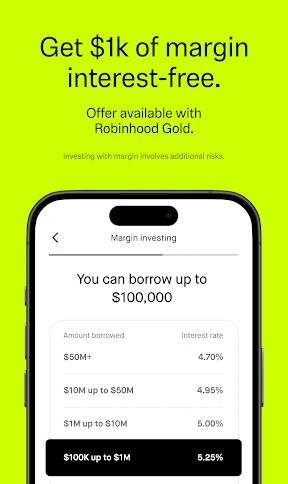

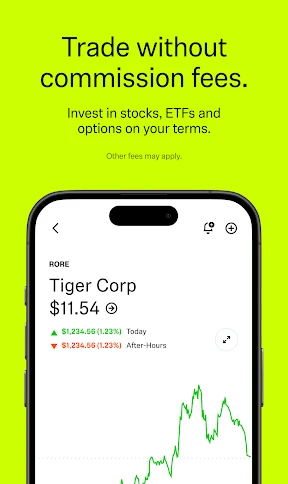

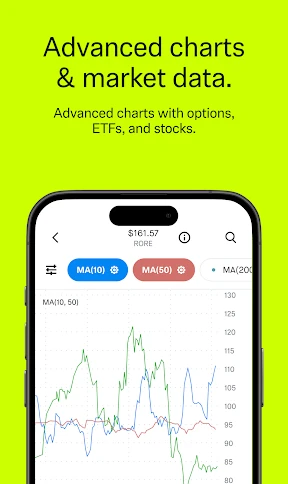

Now, let’s talk features. Robinhood offers commission-free trades, which is a game-changer for small investors like me who might not have the big bucks to spend on fees. The app also provides a feature called "Robinhood Gold," which gives you access to bigger instant deposits and professional research reports. If you’re serious about your investments, this might be worth the upgrade.

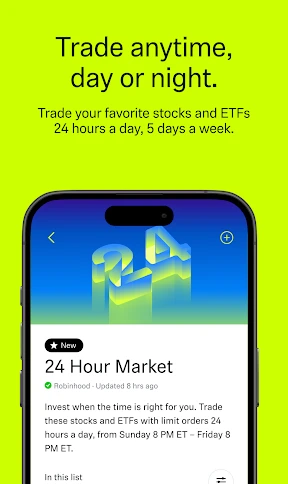

Another cool feature is the ability to trade cryptocurrencies directly on the app. While I’m no crypto expert, it’s nice to have everything in one place rather than juggling multiple platforms. The app also sends notifications about price movements and relevant news, so you’re always in the loop.

Learning and Growing

For newbies, Robinhood has some educational resources, but I found them a bit lacking. There are articles and snippets of information, but if you’re looking for in-depth tutorials or courses, you might need to look elsewhere. That said, the app’s simplicity allows you to learn by doing, which is often the best way to grasp investment concepts.

Security and Trust

Security is a big deal when it comes to handling money online, and Robinhood seems to take it seriously. The app offers two-factor authentication, which gives me peace of mind. Additionally, Robinhood is a member of the SIPC, which means your investments are protected up to $500,000. It’s always comforting to know that your hard-earned money is safe.

On the downside, Robinhood has faced some controversies in the past, especially during the GameStop saga. It’s crucial to stay informed and understand the platform’s policies before diving in too deep.

All in all, Robinhood is a fantastic app for those looking to dip their toes into the investment world without getting overwhelmed. It’s not perfect, but it’s a solid starting point that makes investing more accessible to everyone. Whether you’re trading stocks or exploring the cryptoverse, Robinhood is worth checking out. Happy investing!

Screenshots