rapid! Pay

4.1 Finance Updated January 7th, 2026

Ever found yourself in a pinch, waiting on a paycheck that feels like it's taking forever to arrive? Let me introduce you to rapid! Pay, the app that's all about making sure you get your hard-earned cash without the wait. I've been exploring this app, and honestly, it's like having a financial buddy in your pocket.

Getting Started with rapid! Pay

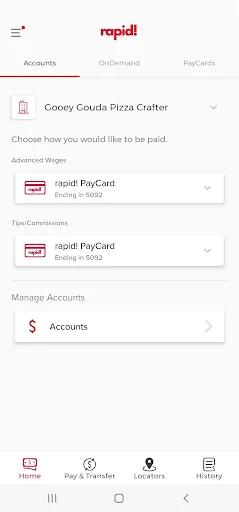

First off, diving into rapid! Pay is as smooth as butter. You download it, set up your account, and boom, you're ready to roll. The interface is super intuitive, and even if you aren't a tech wizard, you'll find navigating through it a breeze. It's designed to give you quick access to your funds, and who doesn't love that?

Features That Stand Out

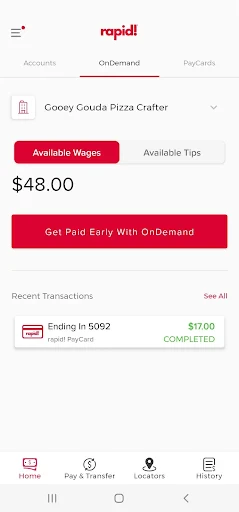

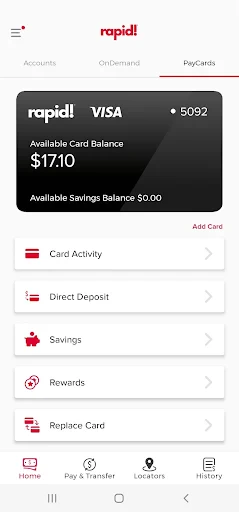

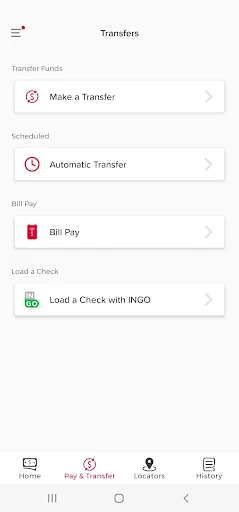

One of the standout features has to be the instant access to wages. No more waiting for payday like it's Christmas morning. With a few taps, you can transfer your earnings to your bank account or use the prepaid card linked to the app. It's like magic, but real!

Another cool aspect is the budgeting tools. The app allows you to track your spending and manage your finances with ease. It's like having a personal accountant who doesn't judge your spending on coffee.

Security You Can Trust

Now, I know what you're thinking: "Is my money safe?" Absolutely. rapid! Pay uses top-notch security measures to protect your data and funds. It's reassuring to know that while you're accessing your money quickly, it's also being safeguarded against digital baddies.

Why It Might Be Your Next Download

So, why should you consider downloading this app? If you're someone who likes to have control over your finances and hates waiting for payday, this app is a game-changer. It's convenient, reliable, and offers a modern solution to an age-old problem.

In a world where time is money, rapid! Pay ensures you're not wasting either. Whether you need to pay bills, shop, or just have some extra cash on hand, this app has got your back. It's a financial revolution in your pocket.

Wrapping it up, if you're looking for an app that seamlessly integrates into your life and offers financial flexibility, give rapid! Pay a whirl. It's like having your paycheck on speed dial, and honestly, who wouldn't want that?

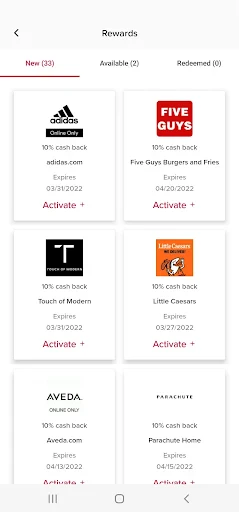

Screenshots