PREMIER Credit Card

4.7 Finance Updated January 7th, 2026

Have you ever felt the thrill of having a credit card that not only caters to your financial needs but also rewards you handsomely? Well, let me introduce you to the PREMIER Credit Card, a financial product that promises to bring a breeze of convenience and benefits to your everyday transactions.

Unpacking the Features

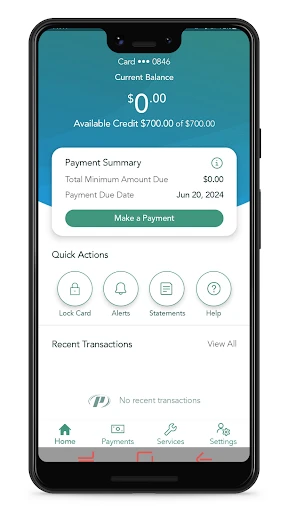

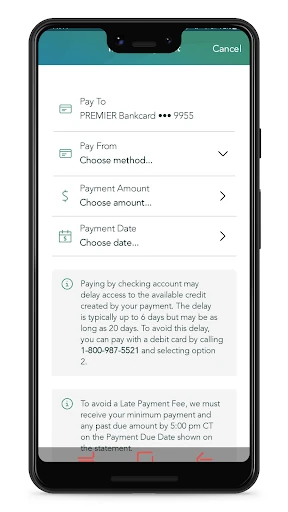

First off, let's dive into the features that make the PREMIER Credit Card stand out. This card is designed with a user-friendly interface that makes managing your finances a breeze. You can easily track your expenses, set up auto-payments, and even receive alerts for due payments. The app associated with the card is intuitive and easy to navigate, which makes it perfect for users of all ages.

Another cool feature is the rewards program. Every time you swipe your card, you earn points that can be redeemed for a variety of goodies such as gift cards, discounts on travel, or even cashback. It’s like getting a little pat on the back every time you spend!

Security and Peace of Mind

In the realm of credit cards, security is paramount, and the PREMIER Credit Card doesn’t disappoint. It employs top-notch security measures to ensure that your transactions are safe and sound. You’ll find features like fraud detection and real-time alerts for any suspicious activity. Plus, the customer service team is always on standby to assist you with any issues or queries.

Moreover, the app provides a detailed report of all your transactions, which helps in keeping a tab on your spending habits. It’s like having a personal financial advisor right in your pocket!

But let's not forget about the interest rates. The PREMIER Credit Card offers competitive rates which are a relief, especially if you're prone to carrying a balance from month to month. The terms are laid out clearly, so there’s no hidden fine print to worry about.

Final Thoughts

In conclusion, the PREMIER Credit Card is a solid choice for anyone looking to enhance their financial toolkit. With its robust features, stellar customer support, and rewarding benefits, it’s a card that truly lives up to its name. Whether you're a frequent traveler or someone who simply wants to manage their daily expenses with ease, this card has got you covered.

So, if you're in the market for a credit card that offers both convenience and rewards, I’d say give the PREMIER Credit Card a shot. It might just make your financial life a whole lot easier!

Screenshots