Possible: Fast Cash & Credit

4.4 Finance Updated January 7th, 2026

Let me tell you about an app that caught my attention recently, Possible: Fast Cash & Credit. I stumbled upon it while searching for solutions to streamline my finances without the usual hassle of credit checks and lengthy approval processes. This app promises a quick and convenient way to access funds when you're in a pinch. Intrigued, I decided to dive in and see if it lives up to the hype.

Getting Started with Ease

Setting up Possible: Fast Cash & Credit was surprisingly straightforward. All I needed was my smartphone, and within a few taps, I had the app downloaded from the app store. The user interface is sleek, with a minimalistic design that doesn’t overwhelm you with unnecessary information. It’s like the app knows you’re here for one thing—fast cash—and it delivers just that.

How It Works

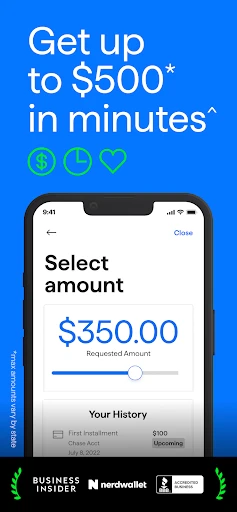

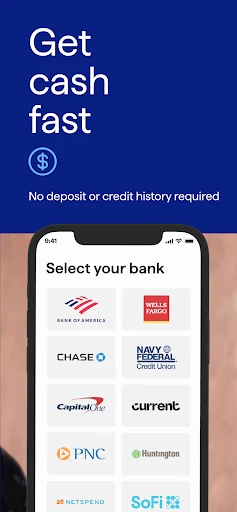

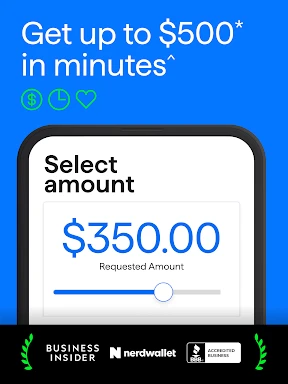

The magic of this app lies in its simplicity. Unlike traditional lending options, you don’t have to worry about your credit score taking a hit. Instead, Possible: Fast Cash & Credit uses bank data to assess your ability to repay. This method not only speeds up the process but also makes it accessible to individuals who might struggle with conventional credit checks.

Once you apply, the app quickly reviews your information and lets you know if you’re approved. The funds land in your account within a matter of minutes—perfect for those unexpected expenses that life loves to throw our way.

Features that Stand Out

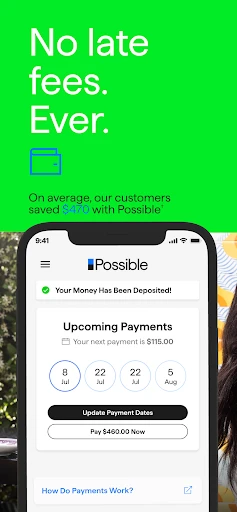

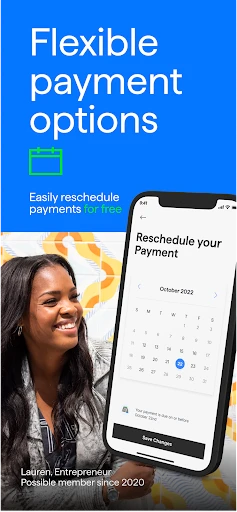

One feature that really stood out to me was the flexible repayment plan. The app allows you to repay the borrowed amount in installments, giving you the breathing room you need to manage your finances without stress. It’s like having a financial cushion that adapts to your lifestyle.

Another noteworthy aspect is the app’s transparency. You’re always in the loop about how much you owe and when the payments are due. There are no hidden fees lurking in the shadows, which is a refreshing change from the norm.

Final Thoughts

In a world where financial flexibility is crucial, Possible: Fast Cash & Credit offers a lifeline to those in need. It’s not just about getting quick cash; it’s about creating a system that respects your financial situation and works with you to achieve stability. If you’re looking for a reliable, user-friendly app to tide you over during tough times, this one might just be worth a shot.

Overall, I found Possible: Fast Cash & Credit to be a game-changer in the world of finance apps. It’s straightforward, efficient, and most importantly, it keeps the user’s needs at the forefront. Give it a whirl if you’re curious—you might find it’s exactly what you’ve been searching for.

Screenshots