ONE@Work (formerly Even)

4.8 Finance Updated January 7th, 2026

Hey there, app enthusiasts! Today, I want to dive into the world of financial wellness and take a closer look at the app ONE@Work (formerly known as Even). This app promises to bring some financial peace of mind to employees, and as someone who’s always on the lookout for tools that can help manage money better, I just had to give it a try.

What is ONE@Work?

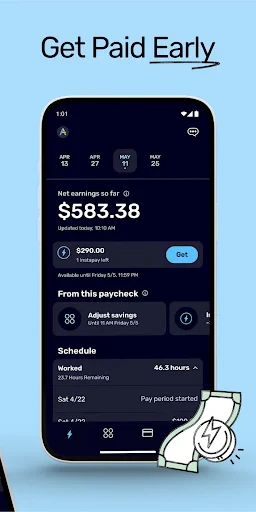

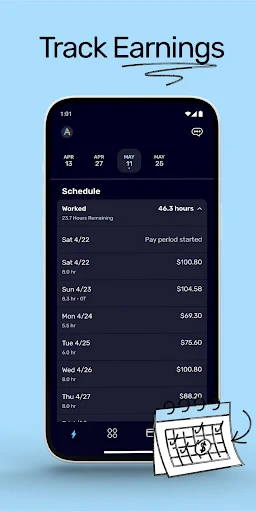

At its core, ONE@Work is designed to provide employees with early access to their earned wages, helping them manage cash flow issues without the stress of waiting for payday. It’s like having a little financial cushion that you can tap into when unexpected expenses pop up. And let’s be real, who hasn’t been there?

Getting Started with ONE@Work

Setting up the app is pretty straightforward. Once you download it from the app store, you’ll need to link it to your employer. Not all companies are partnered with ONE@Work, so that’s something to keep in mind. Once you’re connected, you can view your available earnings and choose to transfer a portion of your wages directly into your bank account. Seriously, it’s as simple as a few taps on your phone.

Features that Stand Out

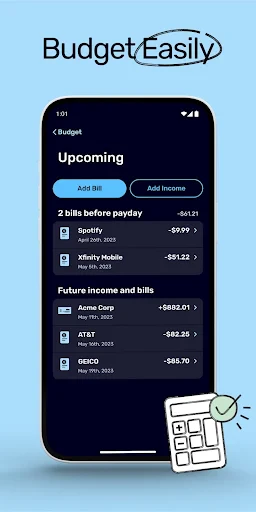

What really caught my attention are the budgeting tools within the app. They allow you to plan out your expenses and see how much you can safely spend without jeopardizing your financial goals. It’s like having a pocket-sized financial advisor right on your smartphone. Plus, the app provides reminders and insights that help you stay on top of your spending habits. Pretty neat, right?

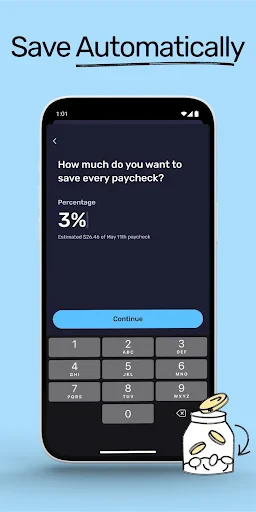

Another feature worth mentioning is the savings option. The app encourages users to set aside a little money from each paycheck, which is a great way to build an emergency fund without much effort. You can set your savings goals, and the app will help you stay on track.

My Personal Experience

Using ONE@Work has been a game-changer for me. The ability to access my wages ahead of time has saved me more than once from the dreaded overdraft fees. I also found the budgeting tools incredibly helpful in keeping my finances organized. It’s like a financial safety net that gives me peace of mind, especially during those months when unexpected bills come knocking.

While the app isn’t perfect and does require your employer’s participation, the benefits it offers are definitely worth considering. If your employer is on board, I’d highly recommend giving it a shot.

Final Thoughts

In conclusion, ONE@Work is more than just an app—it’s a financial ally in your pocket. It provides practical tools and insights that make managing money a bit less daunting. Whether you want to get ahead of your bills or save up for a rainy day, this app has got you covered. So, if you’re looking for a way to take control of your financial life, this app might just be your new best friend. Give it a try and see how it can make a difference for you!

Screenshots