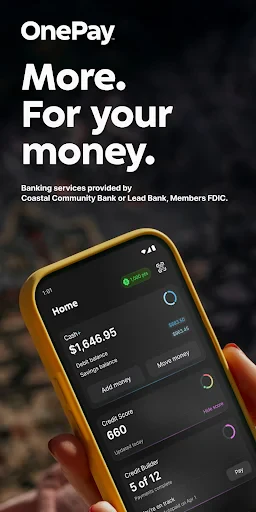

OnePay – Mobile Banking

4.7 Finance Updated January 7th, 2026

If you're anything like me, managing money can sometimes feel like a juggling act. Between keeping track of expenses, setting up budgets, and making sure bills are paid on time, it can get overwhelming. Enter One — Mobile Banking, a nifty app designed to simplify financial management right from your smartphone. So, I decided to give it a whirl and share my thoughts on how it stands up to the task.

A New Way to Bank

Gone are the days of standing in long lines at the bank. With One, everything you need is at your fingertips. The app offers a seamless interface that's both intuitive and visually appealing. Signing up was a breeze; I just downloaded the app, entered my details, and voilà — I was set up in minutes.

Features That Stand Out

One of the things that caught my attention was the app's ability to create multiple Pockets. Think of these as virtual envelopes where you can stash away money for specific purposes. Whether it's saving up for a vacation or setting aside funds for bills, Pockets makes it incredibly easy to organize your finances.

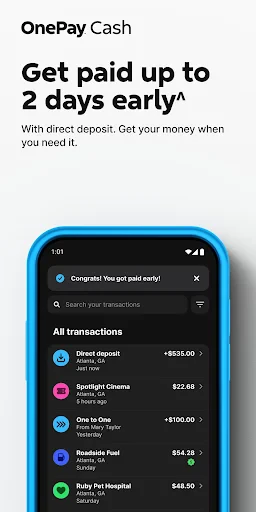

Another standout feature is the app's integration with various payment platforms, allowing you to link your cards and accounts effortlessly. Plus, with real-time transaction notifications, you're always in the loop with your spending habits.

User Experience

The user experience with One is top-notch. The app is designed with the user in mind, ensuring that all features are easily accessible. I found the navigation smooth, with no unnecessary clutter. The app even provides spending insights, which is great for those who love to keep an eye on their financial health.

Security is another area where One shines. With biometric authentication and advanced encryption, I felt confident knowing my data was safe. It's clear they've prioritized user security, which is always a plus in my book.

Conclusion

Overall, One — Mobile Banking is a solid choice for anyone looking to take control of their finances from their mobile device. The app is packed with features that not only make banking convenient but also fun. If you're tired of traditional banking hassles and want everything in one place, One might just be the solution you've been searching for. Give it a try, and you might find yourself wondering how you ever managed without it!

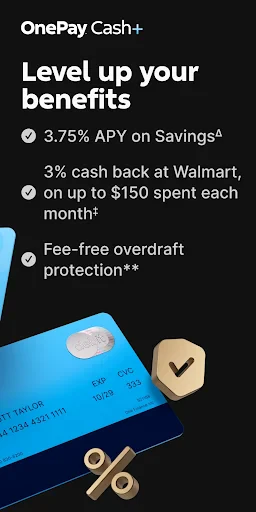

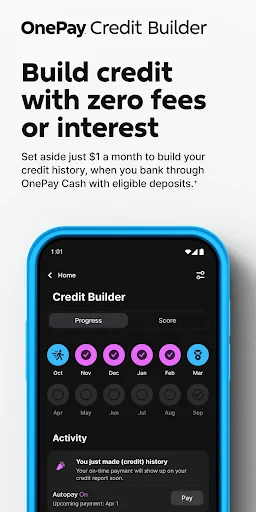

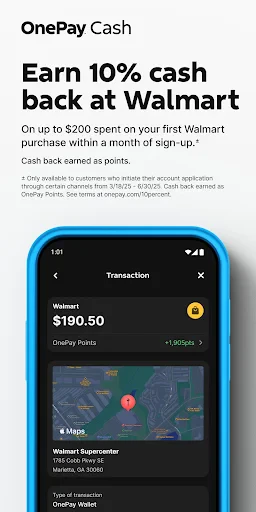

Screenshots