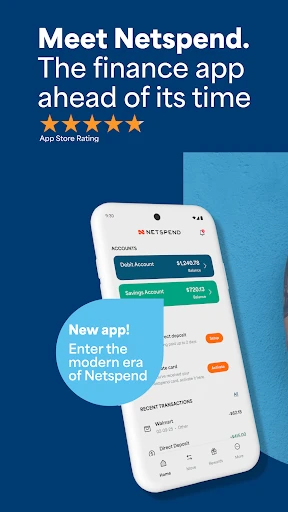

Netspend Wallet

4.1 Finance Updated January 7th, 2026

So, let's dive into the world of the Netspend Wallet, shall we? Imagine having all your financial tools right at your fingertips without the hassle of dealing with a traditional bank. That's pretty much what the Netspend Wallet promises, and after using it for a while, I can honestly say it's a game changer for anyone looking to simplify their financial life.

Setting Up and Getting Started

First things first, getting started with Netspend Wallet is a breeze. Just download the app, set up your account, and you're good to go. Within minutes, I had my account up and running, and I was already exploring the various features it offers. The app is available on both Android and iOS, making it accessible to almost everyone with a smartphone.

A Wealth of Features

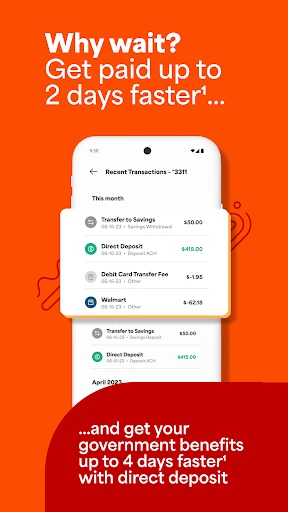

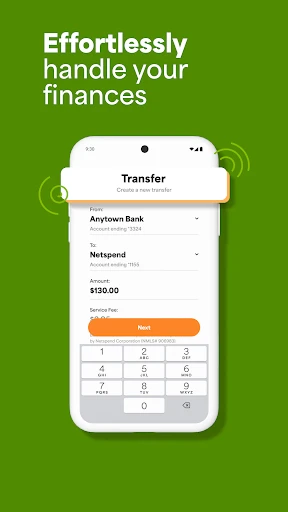

The app is packed with features that make managing your finances easier than ever. You can load money into your account via direct deposit, bank transfer, or even by cash at various retail locations. The best part? You don’t need to worry about a credit check. It's all about accessibility and ease of use.

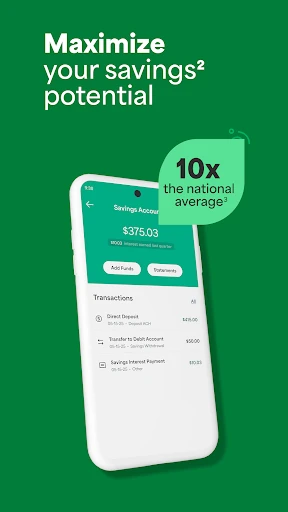

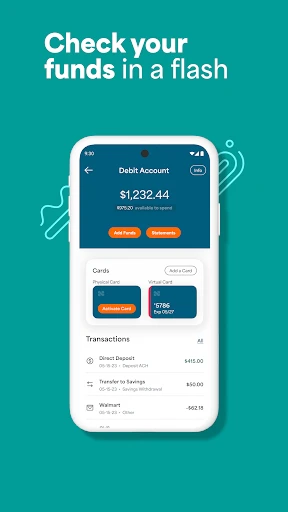

One feature I found particularly useful is the ability to set up alerts for transactions. Whether it's a withdrawal, a deposit, or just a balance inquiry, you can stay updated in real-time, which gives you peace of mind. Plus, the budgeting tools are super handy. I love how the app helps me track my spending habits and suggests ways to save money. It's like having a personal financial advisor in your pocket!

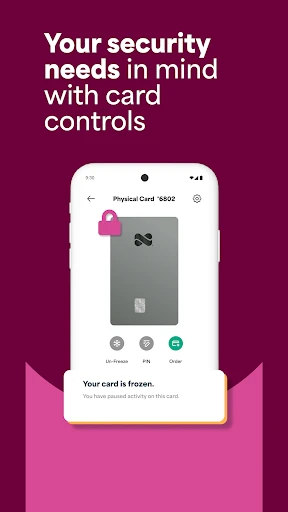

Security and Support

When it comes to security, Netspend Wallet doesn’t cut corners. The app uses high-level encryption to protect your data, and you have the option to set up biometric authentication for added security. If you ever run into issues, their customer support is just a call away, and they’re pretty responsive, which is a huge plus in my book.

On the downside, there are some fees involved, which could be a bummer for some users. While the app is free to download, certain transactions may incur charges. It's important to read through their fee schedule to understand what you might be paying for.

Conclusion

In conclusion, the Netspend Wallet is a fantastic tool for managing your finances without the headache of traditional banking. It's user-friendly, feature-rich, and secure, making it a great option for those who prefer digital solutions for their financial needs. Just be mindful of the fees, and you'll find this app to be an invaluable addition to your smartphone.

So, if you're tired of the old-school banking system and want something that fits right in your pocket, give the Netspend Wallet a try. It might just be the financial companion you've been looking for!

Screenshots