myWisely: Mobile Banking

4.4 Finance Updated January 7th, 2026

When it comes to mobile banking, finding an app that’s both reliable and user-friendly can feel like striking gold. Well, folks, let me introduce you to myWisely: Mobile Banking, an app that has been making waves in the world of digital finance. If you’re someone who likes to keep tabs on your finances with ease, this app might just be your new best friend.

Getting Started with myWisely

First things first, setting up myWisely is a breeze. You’ll just need to download the app from your respective app store, and you’re good to go. The registration process is straightforward, requiring just a few personal details, and in no time, you’ll have access to a plethora of banking features right at your fingertips.

The user interface is sleek and intuitive, meaning even if you’re not tech-savvy, navigating through the app is as smooth as butter. The app is designed to cater to both Android and iOS users, ensuring everyone gets a seamless experience.

Features That Stand Out

One of the standout features of myWisely is its real-time transaction notifications. Imagine having the ability to track your spending instantly, without having to log into your account every time. It’s like having a personal accountant whispering in your ear, keeping you updated on your financial health.

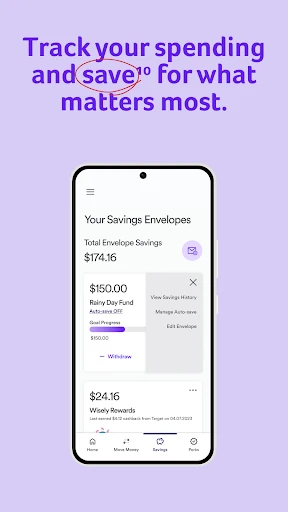

Another fantastic feature is the budgeting tool. If you’re like me and tend to lose track of where your money goes, this tool is a lifesaver. It helps you categorize your expenses, set spending limits, and even gives you insights on how to save more effectively. It’s like having a financial advisor, minus the hefty fees.

Security You Can Trust

In this digital age, security is paramount, and myWisely doesn’t skimp on it. The app employs cutting-edge security measures, including biometric login options and encryption technology, to ensure your information is safeguarded. It’s reassuring to know that your hard-earned money is protected by top-notch security protocols.

Moreover, the app’s customer support is commendable. Whether you have a query about a transaction or need assistance with the app, the support team is just a click away, ready to help you out with prompt responses.

Final Thoughts

In conclusion, myWisely: Mobile Banking is a fantastic tool for anyone looking to manage their finances conveniently and efficiently. It combines essential banking features with a user-friendly interface, making it an excellent choice for both tech-savvy users and those who are new to mobile banking.

With its robust security, real-time notifications, and handy budgeting tools, it’s an app that not only meets but exceeds expectations in the realm of mobile banking. So, if you’re in the market for a reliable banking app, myWisely might just be worth checking out.

Screenshots