MyCard - Contactless Payment

4.0 Finance Updated January 7th, 2026

In today's digital age, handling money has never been more convenient, thanks to the plethora of apps available for contactless payment. One app that stands out in this crowded marketplace is MyCard. As someone who loves the ease of going cashless, I was curious to see what MyCard had to offer beyond the basics. Let me take you through my experience with this app, from installation to daily use.

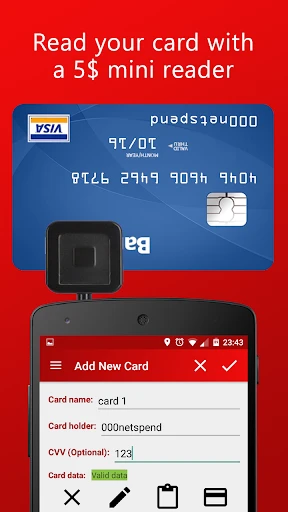

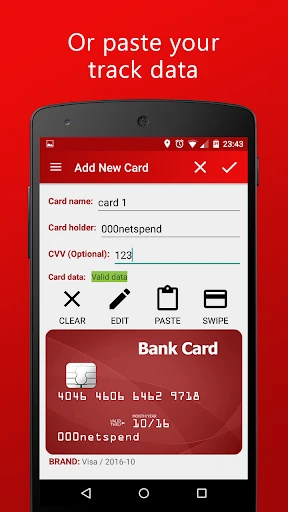

Simplified Setup

First things first, getting started with MyCard is a breeze. The app is available for both Android and iOS, so all you need to do is head over to the respective app store and hit download. The installation process is straightforward, and within minutes, you're ready to dive into the world of contactless payments. Once installed, setting up an account is just as simple. You enter your details, link your bank account or credit card, and voilà, you're all set up.

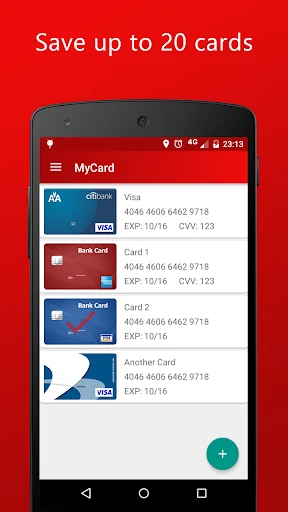

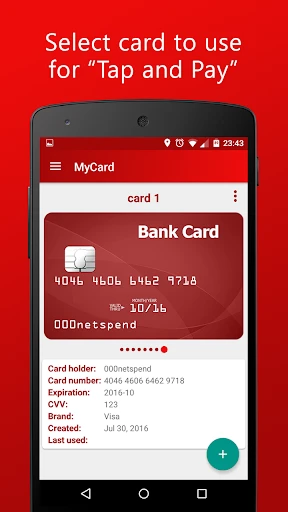

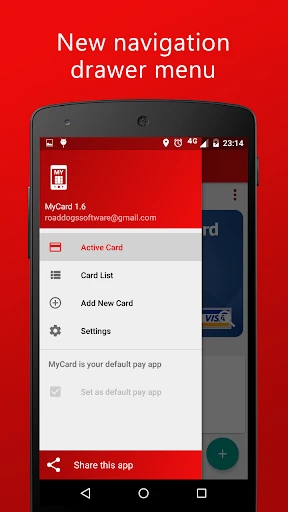

User-Friendly Interface

What truly sets MyCard apart is its user interface. It's sleek, intuitive, and designed for people like me who aren’t tech-savvy. The home screen presents you with all the essential features without overwhelming you with options. I appreciated how everything I needed was just a tap away, from checking my balance to viewing recent transactions.

One feature I found particularly useful was the ability to categorize expenses. This not only helps in tracking where my money goes but also in budgeting for future expenses. It's like having a mini financial advisor in your pocket!

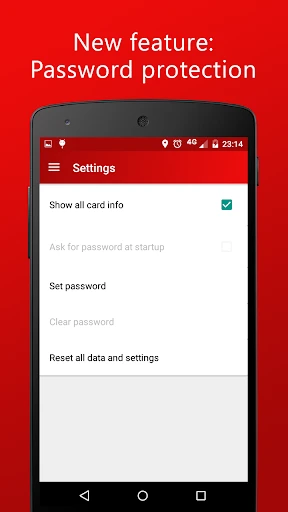

Security Features

In an era where digital security is paramount, MyCard doesn't disappoint. The app employs top-notch encryption to ensure your financial data is secure. Plus, with biometric authentication, I felt an added layer of security knowing that my transactions are safe from unauthorized access.

Additionally, MyCard offers instant notifications for every transaction. This means I can immediately spot any suspicious activity. It's this kind of attention to security detail that gives me peace of mind while using the app.

Everyday Convenience

Using MyCard for everyday purchases is as easy as pie. Whether I’m buying groceries, dining out, or shopping online, the contactless feature works seamlessly. Just a tap, and the payment is done. Gone are the days of fumbling for cash or worrying about the change.

Moreover, the app supports multiple currencies which is a godsend for someone like me who loves to travel. It automatically converts to the local currency, making international transactions hassle-free.

Rewards and Offers

Who doesn’t love a good deal? MyCard keeps things exciting with its regular rewards and offers. Whether it’s cashback on purchases or discounts at partner stores, the app ensures you get more bang for your buck. It's like getting rewarded for spending money, which is a win-win in my book!

In conclusion, MyCard is more than just a contactless payment app; it’s a comprehensive financial tool that makes managing money effortless. From its user-friendly interface to robust security features, it’s clear that the developers have put a lot of thought into making this app both functional and secure. If you’re looking for a reliable and efficient way to handle your finances, MyCard might just be the app for you. Happy spending!

Screenshots