MoneyLion: Bank & Earn Rewards

4.7 Finance Updated January 7th, 2026

Ever stumbled upon an app that makes you feel like you’ve just hit a jackpot in the world of finance? Well, let me introduce you to MoneyLion: Bank & Earn Rewards. It’s not just another banking app; it’s like having your financial guardian angel right in your pocket! I’ve been fiddling around with it for a while now, and let me spill the beans on why this app has been a game-changer for me.

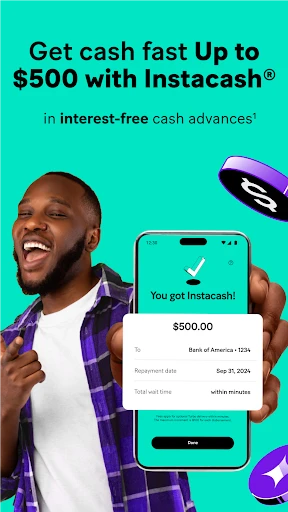

Banking Made Easy

First things first, let’s talk about the banking experience. MoneyLion offers a seamless platform where managing your money is as easy as pie. Setting up an account was a breeze; I didn’t have to jump through hoops or wrestle with unnecessary paperwork. The interface is clean, intuitive, and dare I say, kinda fun to use! I mean, who knew banking could be exciting?

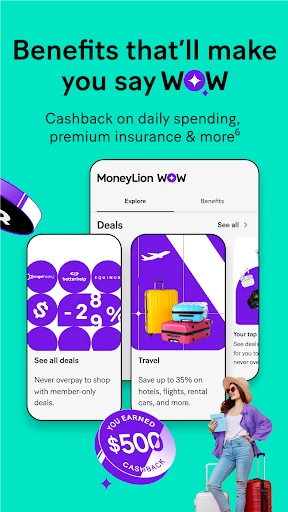

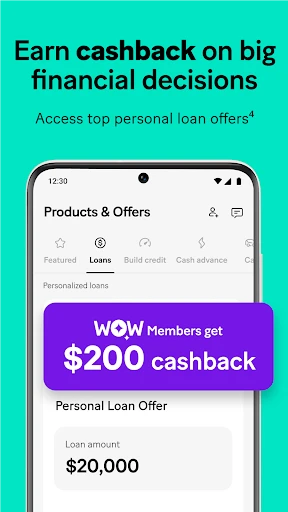

Rewards That Make You Smile

Now, here’s the juicy part – the rewards. MoneyLion has this fabulous feature where you earn points for pretty much every financial move you make. Pay your bills? Earn points. Direct deposit? More points. It’s like a constant pat on the back for adulting! And these points can be converted into gift cards or even cash back, which is like finding a $20 bill in your old jeans.

Investment Opportunities

Feeling a bit adventurous with your finances? MoneyLion’s got you covered with its investment options. It’s super user-friendly, even for someone who’s not a Wall Street whiz. You can start investing with as little as a dollar, which means no more excuses to not dip your toes into the investing pool. Plus, the app provides insights and tips to help you make informed decisions without breaking a sweat.

Security You Can Trust

In the era where data breaches are as common as cat videos, security is a biggie. MoneyLion doesn’t skimp on protecting your sensitive information. It uses top-notch encryption and security protocols to ensure that your data is locked up tighter than Fort Knox. It gives me peace of mind knowing that my financial data isn’t going to end up in the wrong hands.

A Few Quirks

Of course, no app is perfect. While MoneyLion is packed with features, I did notice that the app occasionally lags, which can be a tad frustrating, especially when you’re in a hurry. Also, customer service is primarily through the app itself, which might not be everyone’s cup of tea if you prefer a good old phone call to resolve your issues.

All in all, MoneyLion: Bank & Earn Rewards is a solid app that not only simplifies banking but also makes it rewarding. With its user-friendly interface, robust security, and enticing reward system, it’s a fantastic tool for anyone looking to manage their finances more efficiently. If you haven’t given it a whirl yet, I’d say it’s high time you did!

Screenshots