Klover - Instant Cash Advance

4.6 Finance Updated January 7th, 2026

Ever found yourself in a pinch, waiting for payday, and wishing you could get a little advance on your salary? Well, that’s where Klover - Instant Cash Advance steps in. Let me dive into what this app is all about and see if it’s worth a spot on your smartphone.

Getting Started with Klover

Klover dubs itself as a financial lifesaver, offering cash advances without the hassle of credit checks or hidden fees. Sounds too good to be true? It piqued my curiosity too, so I decided to give it a whirl. The app is available on both Android and iOS, making it super accessible to just about anyone with a smartphone.

Signing up is a breeze. You simply need to connect your bank account, and the app does the rest. It analyzes your income and spending patterns to determine how much it can lend you. The best part? No credit score impact! This can be a huge relief if you’re trying to mend your credit history or simply don’t want to risk a ding on your score.

The Nitty-Gritty Details

Once you’re signed up, you can request a cash advance. The app offers advances ranging from $50 to $200, which can be a great help when you’re in a tight spot. The money gets deposited directly into your bank account, usually within a day. I appreciated that there were no surprises—no hidden fees or scary interest rates lurking in the shadows.

Now, this isn’t free money, of course. You’ll need to repay the advance on your next payday. The app automatically schedules the repayment, which takes the stress out of remembering to pay it back. However, it’s crucial to ensure you’ll have the funds available when the repayment date rolls around to avoid any hiccups.

Features That Make a Difference

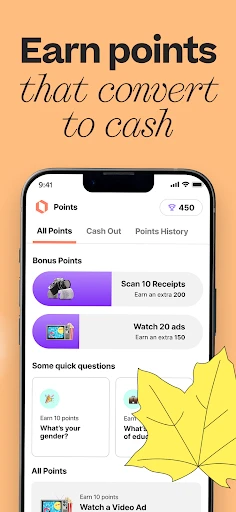

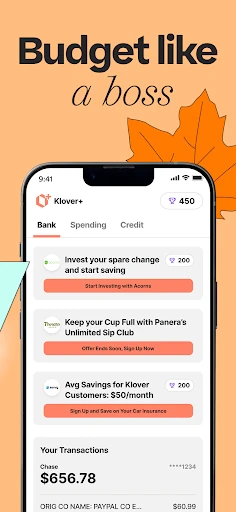

One thing I found particularly nifty about Klover is its Points system. You can earn points by participating in surveys or referring friends, which can then be redeemed for additional services. It’s a smart way to engage users and offers a little something extra for those willing to invest some time into the app.

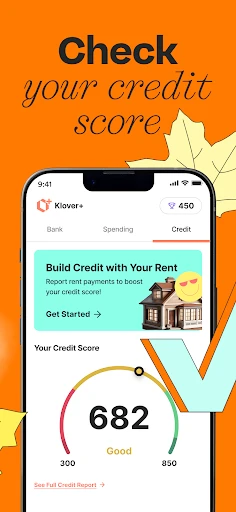

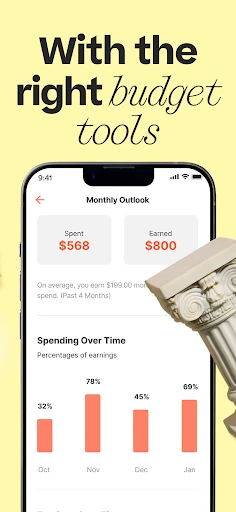

Another advantage is the budgeting tools. The app helps track your spending, offering insights into where your money is going. This feature is a nice bonus for anyone looking to better manage their finances without sifting through endless spreadsheets or other budgeting apps.

Final Thoughts

So, is Klover the app you’ve been waiting for? If you often find yourself needing a bit of financial breathing room before payday, it might just be. The app is user-friendly, straightforward, and transparent, which is a refreshing change in the financial app space.

While it’s not a substitute for financial planning or saving, it can certainly help in a pinch. Just be sure to use it responsibly and keep track of your repayment schedule. Overall, Klover is a solid choice for anyone who needs quick access to cash without the usual headaches of loans or credit checks. Give it a go, and you might find it’s just what you need to tide you over until your next paycheck.

Screenshots