Instant Cash Advance Loan App

4.5 Finance Updated January 7th, 2026

Ever found yourself in a tight spot where you need a bit of cash to tide you over till the next paycheck? Well, that's where the Instant Cash Advance Loan app comes into play. This nifty little app promises to be your financial lifesaver without the hassle of traditional banking methods. So, what's the real deal with this app? Let's dive in and find out!

Getting Started with Instant Cash Advance

First things first, downloading and setting up the app is a breeze. Whether you're on Android or iOS, head over to your respective app store, and in just a few taps, you're ready to roll. The user interface is sleek, modern, and pretty intuitive, which means you don't have to be a tech guru to navigate through it.

Once you've installed it, the registration process is straightforward. All you need is your basic personal information and a bank account where you want the cash to land. The app takes privacy seriously, using encryption to safeguard your data, which is always a plus in my book.

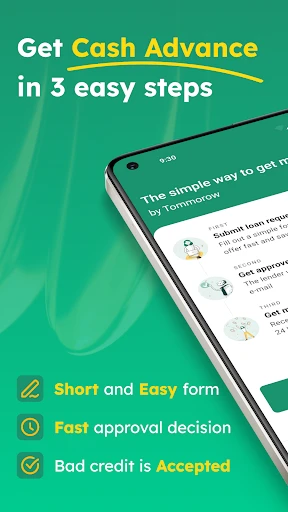

The Loan Process

Now, onto the good stuff - how do you actually get the cash? It's quite simple. The app evaluates your eligibility by taking a look at your banking history. The best part? No credit checks! That's right, even if your credit score isn't something to boast about, you're still in the game.

The amount you can borrow depends on your financial situation, but generally, it’s enough to cover those unexpected expenses. Once approved, the money is zapped into your account almost instantly. It's like having a financial safety net right in your pocket.

Repayment Made Easy

Repaying the loan is just as hassle-free as getting it. The app sets up automatic repayments scheduled around your payday, so you don't have to worry about missing a due date. Plus, they send you reminders, which is super helpful if you're like me and tend to forget things.

If you're worried about the cost, the app is pretty transparent with its fees. There's no fine print here; everything is laid out before you even accept the loan, which I find refreshingly honest. Of course, the key is to only borrow what you can afford to pay back to avoid any financial hiccups.

Customer Support

In the rare case that you hit a snag, the customer support team is just a message away. They're responsive and genuinely helpful, which makes the whole experience much smoother. It’s nice to know there’s a real person ready to help you out on the other side.

So, is the Instant Cash Advance Loan app worth it? For those times when you need a quick cash boost without the red tape, it’s definitely a solid option. Just remember to use it wisely and not as a crutch. After all, financial health is all about balance, right?

All in all, the Instant Cash Advance Loan app is like having a friend who’s got your back when money's tight. It's easy to use, quick to deliver, and doesn’t judge you based on your credit score. Give it a spin next time you’re in a pinch, and see for yourself!

Screenshots