Green Dot - Mobile Banking

3.6 Finance Updated January 7th, 2026

If you're like me, always on the lookout for ways to make managing money a tad less cumbersome, then Green Dot - Mobile Banking might just be the app for you. I've spent a good amount of time tinkering with this app, and I’m here to spill the beans on what it brings to the table.

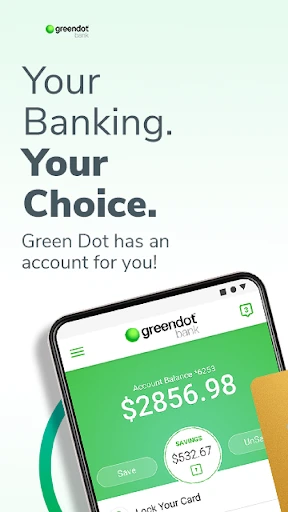

Your Money, Your Control

The first thing that struck me about Green Dot - Mobile Banking is how it really puts you in the driver’s seat when it comes to managing your finances. From the get-go, the app’s user interface is sleek and intuitive. Navigating through it feels like a breeze, even if you're not particularly tech-savvy. You can view your account balance, track your spending, and even set up direct deposits without any hassle.

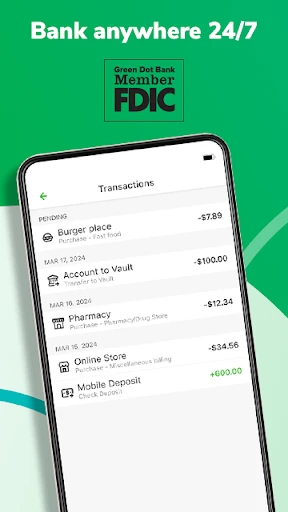

Features That Make Life Easier

One of the standout features of this app is the ability to deposit checks using your phone’s camera. It’s like having a bank right in your pocket. No more rushing to the bank before it closes. You just snap a picture of the check, and boom, the money is in your account. Plus, there’s the added benefit of real-time transaction notifications. Every time you spend, you get an instant alert, helping you keep tabs on your money.

Another feature worth mentioning is the cash-back rewards. Who doesn’t like getting a little something back when they spend? With Green Dot, eligible purchases earn you cash back, which is a sweet bonus when you're out shopping for groceries or grabbing a coffee.

Security You Can Trust

Let’s talk about security because, let’s face it, when it comes to mobile banking, that’s a top concern. Green Dot uses advanced security measures to keep your information safe. It’s like having a digital vault for your money. The app requires a password or biometric login, adding an extra layer of protection to your account. Plus, if you ever misplace your card, you can easily lock it from within the app to prevent unauthorized use.

But it doesn’t stop there. The app also offers a feature that allows you to set up custom alerts for transactions, giving you peace of mind knowing you’ll be notified if anything fishy happens with your account.

Wrapping It Up

In a nutshell, Green Dot - Mobile Banking is a robust app that offers a suite of features designed to make banking easier and more secure. Whether you’re depositing checks, earning cash back, or just keeping a close eye on your spending, this app has got you covered. It’s like having a personal assistant for your finances, minus the hefty price tag.

So, if you're looking to simplify your banking experience and want an app that offers both convenience and security, give Green Dot a whirl. It might just become your new favorite financial sidekick.

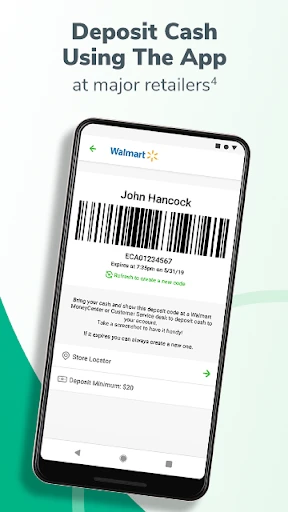

Screenshots