GO2bank: Mobile banking

4.5 Finance Updated January 7th, 2026

Ever felt the hassle of managing your finances on the go? Yeah, me too. But then I stumbled upon an app that just might make that daunting task a bit more manageable: GO2bank. Let me walk you through my experience with this nifty mobile banking app.

Getting Started with GO2bank

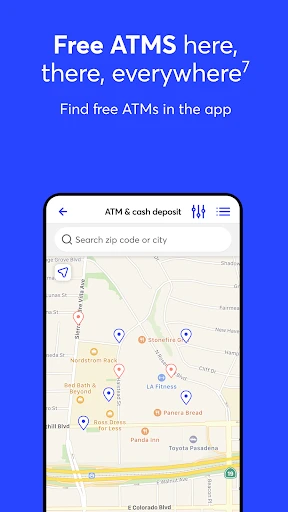

First things first, downloading and setting up GO2bank was a breeze. Available on both Android and iOS, this app is designed for those of us who want a simple yet efficient way to handle our banking needs without the need to visit a physical branch. After a quick download and a straightforward registration process, I was ready to dive into the features.

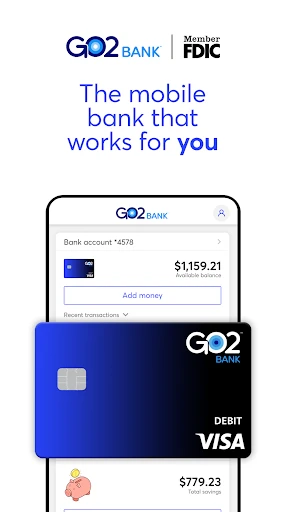

Simplified Banking at Your Fingertips

GO2bank offers a user-friendly interface that doesn’t overwhelm with too many options or jargon. The moment you log in, you're greeted with a dashboard that highlights your account balance, recent transactions, and any upcoming bills. It's all about making your banking experience as seamless as possible.

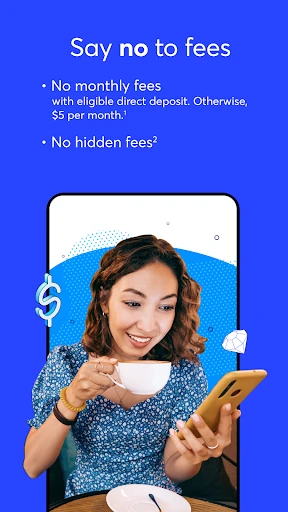

One of the standout features is the early direct deposit. If you’re like me and hate waiting for payday, this feature allows you to get your paycheck up to two days earlier. Plus, there are no monthly fees if you set up direct deposits. That’s a win-win in my book!

Security and Support You Can Count On

When it comes to banking, security is a top priority, and GO2bank doesn’t disappoint. The app leverages the latest encryption technology to safeguard your information, offering peace of mind whether you’re transferring money or paying bills. And if you ever run into any issues, their customer support is just a call or click away.

Another cool feature is the ability to lock and unlock your card with a simple tap. This has been particularly handy for me during those inevitable moments when I misplace my card. No more frantic searching or unnecessary stress!

Beyond Basic Banking

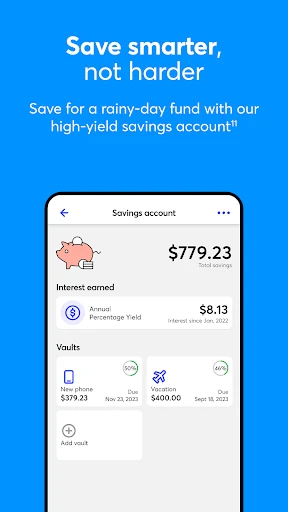

GO2bank isn’t just about the basics. There’s also a savings account feature that offers a pretty competitive interest rate. It’s not going to make you rich overnight, but it’s a nice little perk for keeping your savings in check. And for those who like a bit of fun, the app occasionally offers cashback rewards on certain purchases. Who doesn’t love a good deal?

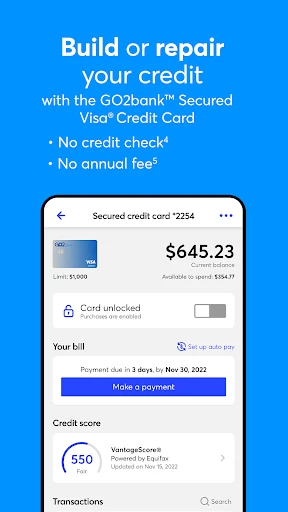

For those who are just starting with credit or looking to improve their score, GO2bank provides a secured credit card option. It’s a neat way to build or rebuild your credit without diving into debt.

The Final Verdict

So, what’s the final take? GO2bank is a solid contender in the mobile banking arena. It’s not perfect, but its straightforward approach to banking makes it a great choice for anyone looking to simplify their financial life. Whether you’re tech-savvy or just dipping your toes into the digital banking world, this app offers something for everyone.

In a world where time is of the essence, having a reliable banking app like GO2bank that you can trust is invaluable. Give it a try and see if it fits your lifestyle as well as it did mine. Happy banking!

Screenshots