Go Program Way2Go Card

3.7 Finance Updated January 7th, 2026

Have you ever found yourself juggling multiple financial tasks and wished for a simpler solution? Well, let me introduce you to the Way2Go Card, an app designed to streamline your financial management, especially for those who receive government benefits. As someone who enjoys simplifying life, I decided to take this app for a spin and see if it truly holds up to its promises.

Getting Started with the Way2Go Card App

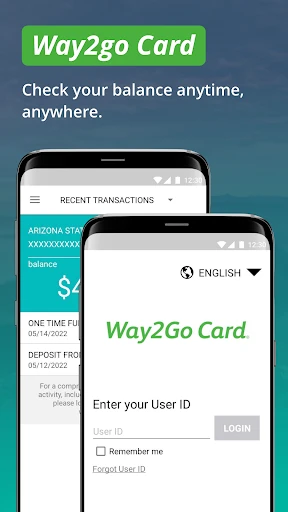

First things first, downloading and setting up the Way2Go Card app is a breeze. Available on both Android and iOS platforms, you can easily find it on their respective stores. I found the installation process to be straightforward, requiring only a few taps to get it up and running. The moment you open the app, you're greeted with a clean and intuitive interface that doesn’t overwhelm you with options. It's clear from the get-go that the developers focused on user-friendliness.

Exploring Features

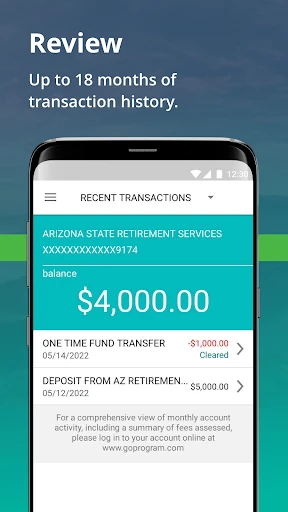

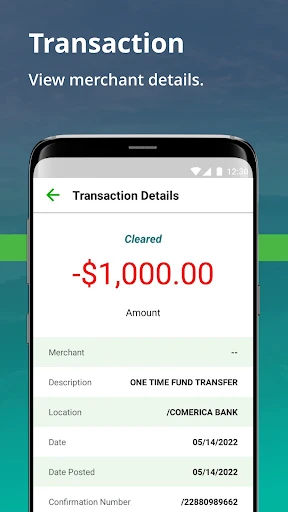

Once inside, I was eager to explore the features. The app provides a comprehensive overview of your account, displaying your balance right on the home screen. It's a relief not having to navigate through endless menus to find this crucial information. One of the standout features for me is the transaction history. It’s detailed, yet simple to understand, listing all your recent transactions in a neat order. You can even filter these transactions by date or type, making it easy to track spending habits.

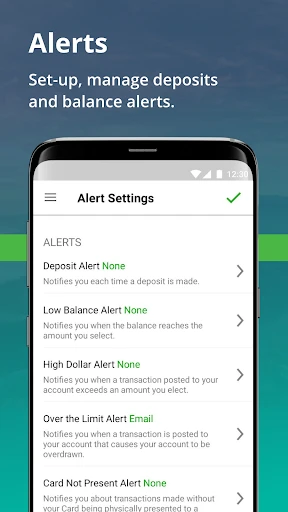

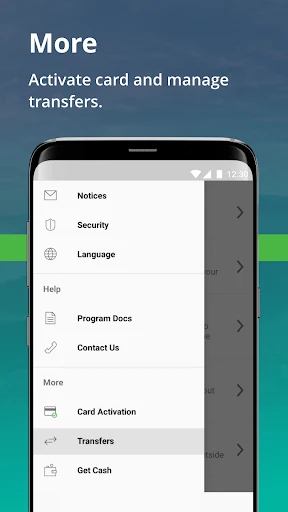

Another feature worth mentioning is the in-app notifications. You receive alerts about incoming deposits, which is fantastic for staying updated on your financial status without constantly logging in. Plus, there’s an option to set up direct deposits and manage your account preferences, giving you full control over how you handle your finances.

Security and Support

Security is a top priority when dealing with financial apps, and the Way2Go Card doesn’t disappoint. The app uses robust encryption to protect your data, and it requires a secure login every time you access it. I appreciated the additional layer of security with the fingerprint login feature, which adds convenience without compromising safety.

In case you run into any issues, the app offers a comprehensive help section. There’s a FAQ section that covers most common queries, but if you need personalized assistance, customer support is just a tap away. I had a small hiccup setting up direct deposit, and the support team was quick to respond and resolve my issue. Their responsiveness definitely adds to the overall user experience.

Final Thoughts

All in all, the Way2Go Card app has proven to be a reliable companion in managing my finances. Its user-friendly interface, coupled with robust features and exceptional security measures, makes it a standout choice for anyone looking to simplify their financial dealings. Whether you're receiving government benefits or simply want a more streamlined way to manage your money, this app is definitely worth checking out. It's like having a personal financial assistant right in your pocket!

Screenshots