FloatMe: Budget & Cash Advance

4.6 Finance Updated January 7th, 2026

Ever found yourself in that all-too-familiar situation where payday is just a little too far away, and the unexpected expenses start piling up? We've all been there, and thankfully, FloatMe: Budget & Cash Advance is here to lend a helping hand. If you're looking for a way to bridge those financial gaps without diving into overdrafts or high-interest payday loans, FloatMe might just be your new best friend.

What is FloatMe?

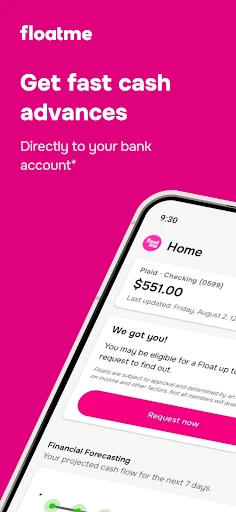

FloatMe is an app designed to provide users with small cash advances to help manage their budget until the next paycheck. It's like having a mini safety net tucked away in your pocket. Available for both Android and iOS, this app is geared towards helping you avoid overdraft fees and manage your finances more effectively.

Getting Started

Setting up FloatMe is a breeze. After downloading the app, you'll need to link your bank account, which might raise a few eyebrows, but rest assured, the process is secure and straightforward. FloatMe uses bank-grade security to ensure your information is safe. Once linked, the app analyzes your spending habits to understand your financial patterns better.

Features That Stand Out

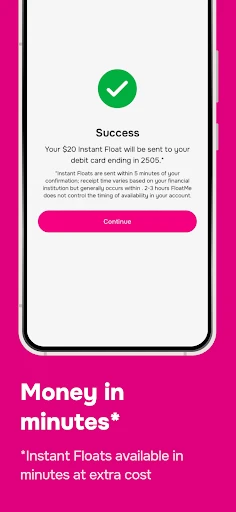

One of the coolest features of FloatMe is the instant cash advance. You can request up to $50 to help cover those pesky expenses that just can’t wait. The best part? No interest. That’s right, FloatMe advances you the cash without charging an arm and a leg in interest fees. You just pay a small subscription fee of $1.99 a month. Think of it as a small price to pay for peace of mind.

Another feature worth mentioning is the balance alerts. FloatMe keeps an eye on your account and sends you alerts when your balance is running on fumes. It's like having a financial advisor who’s got your back 24/7.

User Experience

The app is designed with user-friendliness in mind. The interface is clean, intuitive, and easy to navigate. Even if you’re not tech-savvy, you’ll find it pretty straightforward to request advances and check your financial status. Plus, the customer support is top-notch, always ready to assist if you run into any hiccups.

Final Thoughts

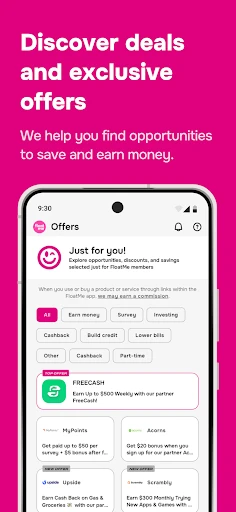

So, is FloatMe worth downloading? If you often find yourself in need of a small financial boost before payday, then absolutely. Its user-friendly interface, coupled with the much-needed financial support it offers, makes it a handy addition to your smartphone. Sure, it won't solve all your financial woes, but it can certainly help you navigate those tricky days leading up to payday with a bit more ease.

In a nutshell, FloatMe is like that friend who’s always there when you need a little extra support. It’s not about borrowing large amounts but rather about helping you stay afloat without the stress of high-interest fees. Give it a try, and you might just find it’s the financial breath of fresh air you’ve been looking for.

Screenshots