EveryDollar: Budget Planning

4.3 Finance Updated January 7th, 2026

Hey there! If you're anything like me, managing finances can sometimes feel like an uphill battle. That's where EveryDollar: Budget Tracker swoops in like a superhero to save the day. I’ve been using this app for a while now, and let me tell you, it's a game-changer for budgeting and keeping track of every single dollar you spend. So, let’s dive into my experience with this nifty app.

Getting Started with EveryDollar

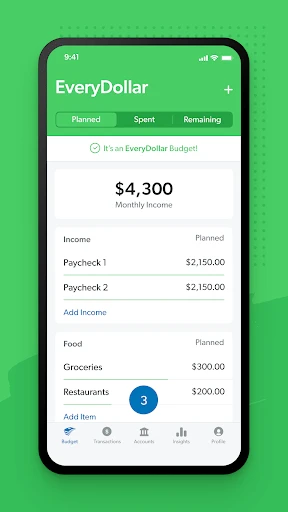

Jumping into EveryDollar is as easy as pie. Once you download and install the app, setting up your budget is straightforward. You start by entering your monthly income and then allocate your funds into different categories like groceries, rent, entertainment, and more. It’s almost like having a digital envelope system, but way cooler and more efficient.

User-Friendly Interface

I love how clean and intuitive the interface is. Honestly, even if you’re not the most tech-savvy person, navigating through the app is a breeze. The dashboard is well-organized, and it gives you a clear snapshot of where your money is going. Plus, the drag-and-drop feature for moving funds between categories is super handy when unexpected expenses pop up.

Tracking Expenses

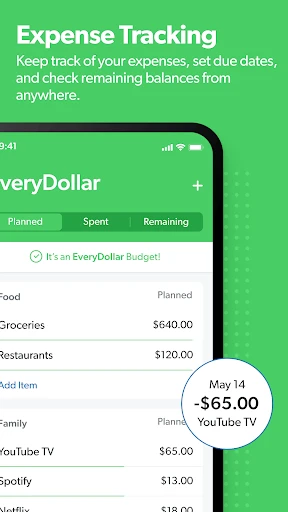

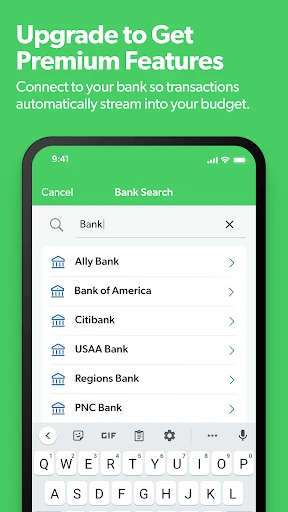

One of the standout features of EveryDollar is how it makes tracking expenses so seamless. You can manually enter each transaction or link your bank account for automatic updates. I personally prefer the manual entry because it gives me a moment to reflect on my spending habits. But hey, having the option to automate is a solid plus for those who want it.

Staying Accountable

Budgeting can sometimes feel like a chore, but EveryDollar turns it into a daily habit that I’ve actually grown to enjoy. The app sends you friendly reminders to log your expenses, helping you stay on track. It’s like having a personal finance coach in your pocket, nudging you to stick to your goals without being intrusive.

Customization and Flexibility

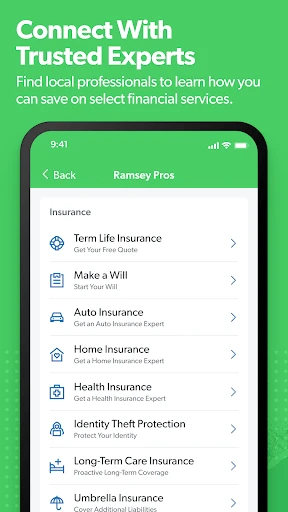

Another thing I appreciate about EveryDollar is its flexibility. You can customize your budget categories to fit your lifestyle, which is perfect because everyone’s financial situation is unique. Whether you’re saving for a vacation, paying off debt, or just trying to live within your means, you can tailor the app to meet your needs.

In conclusion, EveryDollar: Budget Tracker is a must-have for anyone looking to take control of their finances. It’s user-friendly, efficient, and even kind of fun to use. Whether you’re a seasoned budgeter or just starting out, this app provides all the tools you need to manage your money better. So why not give it a try? Your wallet will thank you!

Screenshots