Empower®

3.1 Finance Updated January 7th, 2026

When it comes to financial management apps, there's a plethora of options available, but not all are created equal. Enter Empower®, an app that claims to bring a new level of financial awareness and control to your fingertips. But does it really deliver on its promises? Let’s dive in and see what Empower® has to offer.

Getting Started: The Onboarding Experience

First things first, downloading and setting up Empower® is a breeze. Available for both Android and iOS, you can quickly find it on Google Play or the App Store. The initial setup is straightforward, guiding you through linking your bank accounts and credit cards securely. What impressed me was the app's sleek and intuitive interface, which made the navigation feel seamless.

Features That Stand Out

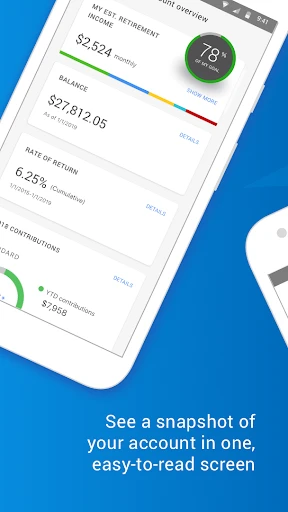

Once you’re all set up, the real magic begins. Empower® isn’t just about tracking expenses; it’s about understanding them. The app offers personalized insights into your spending habits, categorizing transactions in a way that’s easy to digest. It’s like having a financial advisor in your pocket, minus the hefty fees.

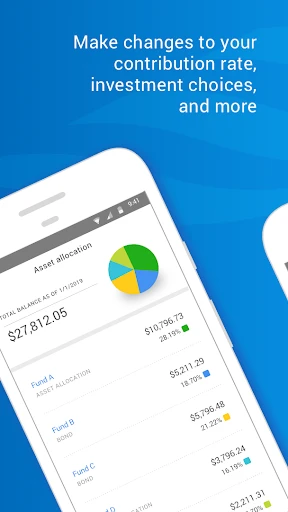

One of the standout features is the automatic savings. You can set your savings goals, and the app will intelligently transfer funds into your savings account based on your spending patterns. It’s a small nudge towards financial responsibility that feels surprisingly impactful.

Budgeting Made Easy

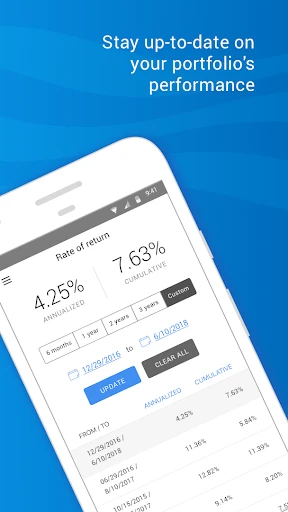

We all know that budgeting can be a drag, but Empower® manages to make it less of a chore. The app provides a comprehensive view of your finances, allowing you to set up budgets for different categories. What’s cool is how it tracks your progress in real-time, sending notifications to keep you on track. I found this feature particularly useful for avoiding overspending during those impulsive shopping sprees.

Security and Privacy

In today’s digital age, security is paramount, and Empower® doesn't skimp on it. The app uses bank-level encryption to protect your data. Plus, with features like two-factor authentication, you can rest easy knowing your financial information is safe from prying eyes.

Customer Support and User Experience

Empower® also shines in the realm of customer support. Whether you have a question about a feature or need help troubleshooting an issue, the support team is responsive and eager to assist. The user experience overall is polished, with smooth transitions and a clean layout that enhances usability.

If there’s one area where Empower® could improve, it might be in offering more educational content for users who are new to budgeting or financial planning. While the app is intuitive, a few more in-app guides or tutorials could go a long way in empowering users.

In conclusion, Empower® delivers a robust suite of features that can genuinely help users take control of their finances. With its user-friendly interface, powerful budgeting tools, and strong security measures, it stands out as a top contender in the financial management app space. It’s not just about managing money; it’s about empowering you to make informed financial decisions. So, if you’re looking for a financial app that’s as proactive as you are, Empower® might just be the perfect fit.

Screenshots