EarnIn: Why Wait for Payday?

4.7 Finance Updated January 7th, 2026

Ever found yourself counting down the days to payday? Well, those days might just be over, thanks to EarnIn: Make Every Day Payday. This nifty little app is revolutionizing the way we access our hard-earned cash, making it possible to get paid as you earn. Sounds like a dream, doesn’t it? Let’s dive into what makes EarnIn tick and why it might just be the app you never knew you needed.

How EarnIn Works

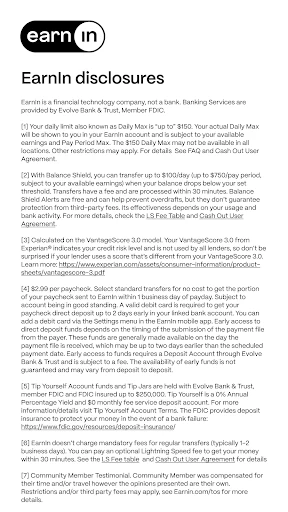

So, here’s the deal: EarnIn isn’t a payday loan, and it doesn’t charge you interest. Instead, it allows you to access the money you’ve already earned without waiting for your paycheck. You just need to share your work hours with the app. The app then calculates how much you’ve earned and lets you cash out up to $100 per day or $500 per pay period. Pretty neat, right?

Setting Up Your Account

Getting started with EarnIn is a breeze. All you need is your employer’s info, a checking account, and a smartphone. Once you’ve downloaded the app, you’ll link it to your bank account and provide details about your employment. The app will then verify your work hours, either through a timesheet or by tracking the hours you spend at your work location using your phone’s GPS. Yes, it’s that smart!

Features You’ll Love

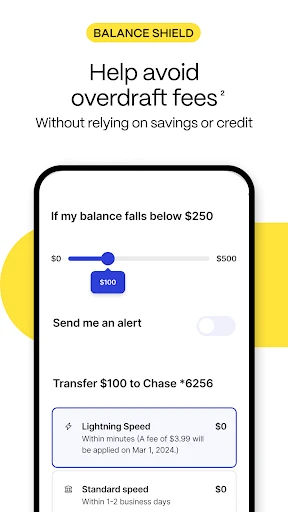

What really sets EarnIn apart are the extra features. For starters, there’s the Balance Shield feature, which helps prevent overdraft fees by sending you alerts when your bank balance is low. You can even set it to automatically cash out up to $100 to keep your balance in check. Plus, EarnIn offers a Cash Back Rewards program. Who doesn’t love getting rewarded for spending money?

Community and Support

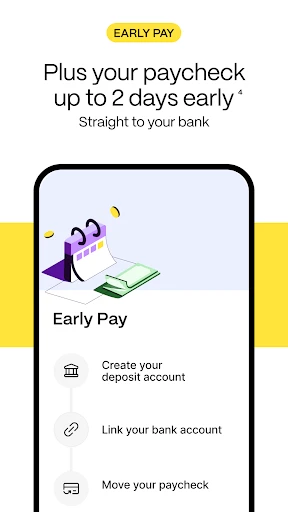

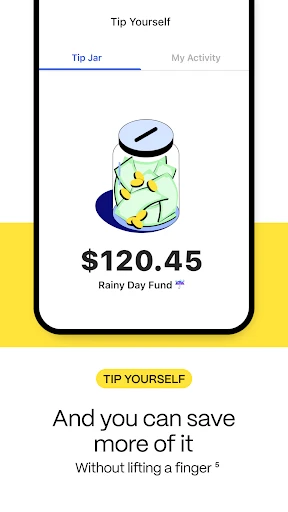

Another cool thing about EarnIn is its community vibe. The app encourages transparency and support among its users. You can join the Lightning Speed program, which allows you to cash out your earnings instantly, and even contribute to a Tip Yourself jar, where you can tip the team based on your experience. These tips are optional, but they help keep the service running smoothly.

Is EarnIn Right for You?

Now, I know what you’re thinking: “Is this too good to be true?” The truth is, EarnIn isn’t for everyone. It works best for folks who are salaried or have regular work hours. If you’re a freelancer with an unpredictable schedule, it might not be the best fit. Also, since it depends on your bank’s processing speed, cashing out might not be instant for everyone.

Overall, EarnIn: Make Every Day Payday is a game-changer for those who need a little financial flexibility. It’s user-friendly, packed with helpful features, and backed by a supportive community. Whether you’re trying to avoid overdraft fees, need quick access to your earnings, or just want to feel more in control of your finances, EarnIn might just be worth checking out. So, why wait for payday when you can make every day a payday?

Screenshots