DasherDirect, by Payfare

4.7 Finance Updated January 7th, 2026

DasherDirect, by Payfare, is an intriguing app that's making waves among delivery drivers. If you're a Dasher, this app is designed to make your life a whole lot easier. But does it really deliver on its promises? Let's dive into the details and see what DasherDirect has to offer.

Getting Started with DasherDirect

First things first, let's talk about getting started with DasherDirect. Signing up is a breeze, especially if you're already a Dasher. The app integrates seamlessly with your current account, which means no tedious paperwork or endless forms to fill out. Once you're in, you get instant access to your earnings, which is pretty sweet if you ask me. No more waiting for weekly payouts – you get your money right when you earn it.

Features That Stand Out

One of the standout features of DasherDirect is the ability to have your earnings deposited directly into the app's built-in bank account. This isn't just a gimmick – it's a fully functional bank account with no monthly fees. You can use it just like any other bank account, complete with a physical debit card that you can use anywhere Visa is accepted.

Another cool feature is the cashback rewards. You get 2% cashback on gas purchases, which is a big deal if you're driving around all day making deliveries. It's a small percentage, but it adds up over time, especially given how much Dashers rely on their vehicles.

User Interface and Experience

The user interface is clean and intuitive. Everything you need is right at your fingertips, and the app runs smoothly without any noticeable glitches or crashes. It's clear that a lot of thought went into designing an app that's easy to use, even if you're not particularly tech-savvy.

One thing I really appreciate is the instant notifications. Whether it's an update on your earnings or a change in your account, the app keeps you in the loop at all times. This transparency is crucial for Dashers who depend on timely information to manage their finances and deliveries effectively.

Security and Reliability

When it comes to handling money, security is a top priority, and DasherDirect doesn't disappoint. The app employs robust security measures to protect your personal and financial information. Plus, the reliability factor is high, with minimal downtime reported by users. This means you can count on the app to be available when you need it most.

Final Thoughts

So, is DasherDirect worth downloading? If you're a Dasher looking for a convenient way to manage your earnings, this app is definitely worth a try. The ease of access to your earnings, the added perks like cashback, and the security features make it a valuable tool in any Dasher's arsenal. While it's not without its limitations, the benefits far outweigh the drawbacks.

In conclusion, DasherDirect, by Payfare, offers a modern solution for modern problems. It's a must-have for Dashers who want more control over their finances and a smoother, more efficient financial experience. Give it a shot and see how it can enhance your dashing journey.

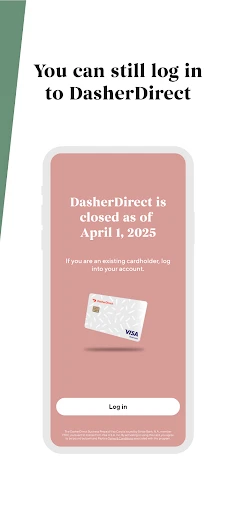

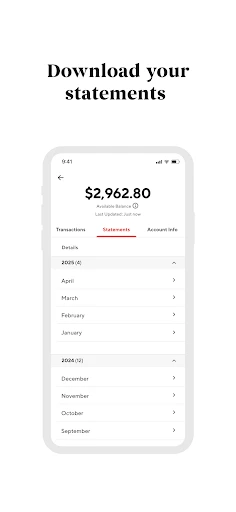

Screenshots