DailyPay On-Demand Pay

4.7 Finance Updated January 7th, 2026

DailyPay On-Demand Pay is an innovative financial app that aims to provide users with more control over their earnings by offering early access to their paycheck. This app is particularly beneficial for individuals who may need immediate access to their wages before the traditional payday. Let's dive into what makes DailyPay a worthy addition to your financial toolkit.

Getting Started with DailyPay

First things first, setting up DailyPay is a breeze. You simply download the app from the App Store or Google Play, create an account, and link your employer. Once the setup is complete, you can start accessing your earned wages whenever you need them. The onboarding process is intuitive, making it easy even for those who aren't tech-savvy.

Features That Stand Out

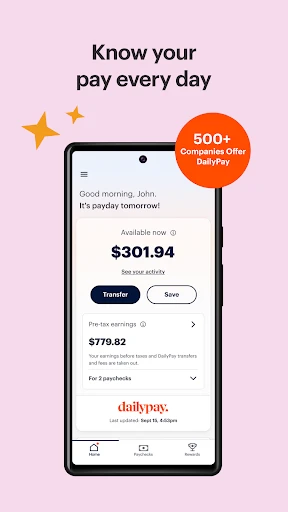

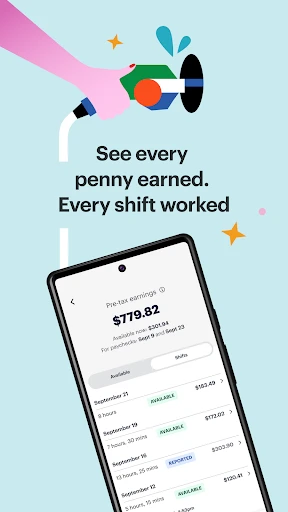

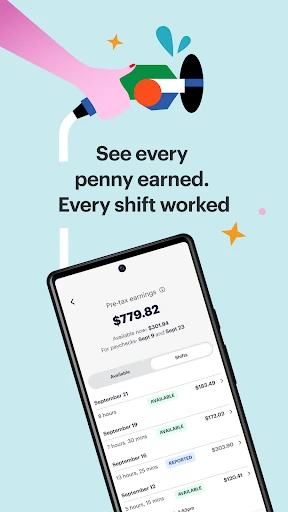

One of the standout features of DailyPay is its real-time balance updates. As you work, your available balance updates, allowing you to see exactly how much you can access at any given time. This transparency is a game-changer for budgeting and financial planning, as it gives you a clear picture of your earnings.

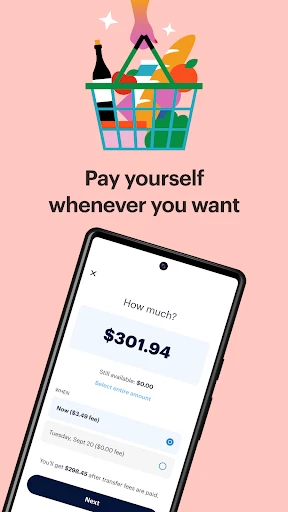

Another great feature is the ability to transfer funds instantly. Whether you need to cover an unexpected bill or just want a little extra cash for the weekend, DailyPay lets you transfer your earnings to your bank account in seconds. It's like a safety net that’s always there when you need it.

User Experience and Interface

The user interface of DailyPay is sleek and user-friendly. Navigating through the app feels intuitive, with each feature clearly labeled and easy to access. The overall design is modern and clean, without any unnecessary clutter that could confuse users. It’s obvious that a lot of thought has been put into making the user experience as smooth as possible.

Notifications are also a big plus. DailyPay sends you alerts about your balance and any transactions, so you’re always in the loop. This feature ensures that you never miss an important update, keeping you informed about your finances without having to constantly check the app.

Security and Trustworthiness

When it comes to handling your hard-earned money, security is paramount. DailyPay employs top-notch security measures to protect your financial data. With encryption and secure servers, you can rest assured that your information is safe from prying eyes. Plus, it's comforting to know that DailyPay partners with reputable employers, adding an extra layer of trustworthiness to their service.

Final Thoughts

In today’s fast-paced world, having access to your money when you need it is crucial. DailyPay On-Demand Pay offers a flexible and reliable solution for those moments when waiting for payday just isn't an option. With its user-friendly interface, real-time updates, and robust security features, this app is a must-have for anyone looking to take control of their financial future. Whether you're dealing with an emergency expense or simply want more flexibility with your earnings, DailyPay is an app worth considering.

Screenshots