Current: The Future of Banking

4.5 Finance Updated January 7th, 2026

Hey there! If you’re anything like me, managing finances can sometimes feel like wrestling an octopus. So many arms, so little control. That's why I was super intrigued when I stumbled upon the app, Current: The Future of Banking. Spoiler alert: It might just be the financial sidekick you never knew you needed.

First Impressions

Alright, let's dive right in. The first thing you notice about Current is its sleek and modern interface. It's like the app designers took a page out of the minimalist playbook, and honestly, I’m here for it. With a clean black and white theme, accented with a pop of green, it feels fresh and inviting. Setting up an account was a breeze, and I didn’t have to jump through hoops to get started.

Features That Stand Out

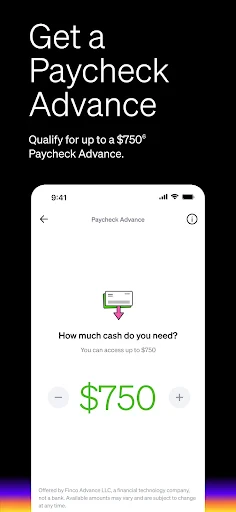

What really caught my attention were the features Current offers. You’ve got your standard mobile banking tools, but there’s more under the hood. The app provides real-time notifications for every card transaction, which is a game-changer if you’re trying to keep track of your spending. And for those of us who are perpetually broke before payday, the early direct deposit feature is a lifesaver. Imagine getting your paycheck two days early—yes, please!

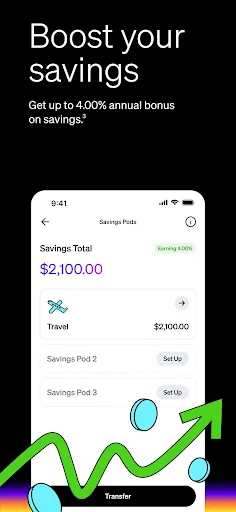

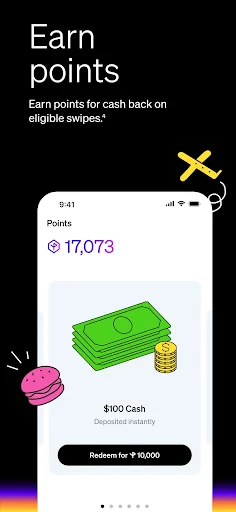

Another nifty feature is the ability to create goals and automatically set aside money for them. Whether it’s saving for that dream vacation or just trying not to blow your budget on takeout, Current’s got your back. And let’s talk about their rewards system. Every time you spend, you earn points that can be redeemed for cash back. Who doesn’t love a little extra cash?

User Experience

Using Current feels intuitive and straightforward. The app runs smoothly, with no annoying lags or crashes, which is a huge plus in my book. The navigation is super user-friendly, making it easy to find what you need without wanting to throw your phone out the window.

Plus, their customer service is top-notch. I had a minor issue setting up my external bank account, and their support team was not only quick to respond but also incredibly helpful. It’s comforting to know that if you run into any hiccups, you’re not alone.

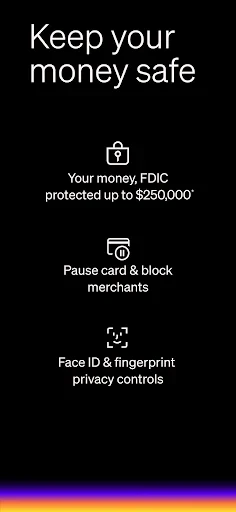

Security

In terms of security, Current doesn’t skimp. They use bank-level encryption to protect your data, which gives me peace of mind. Plus, you can easily lock your card through the app if it ever gets misplaced. It's clear they’ve put a lot of thought into making sure users feel secure.

Final Thoughts

So, is Current: The Future of Banking really the future? It certainly feels like it. With its user-friendly design, robust features, and top-notch security, it’s hard to find a reason not to love it. Whether you’re a tech-savvy millennial or just someone looking to simplify their financial life, Current is definitely worth checking out.

Overall, I’d say Current lives up to its name by keeping everything current—pun intended. So go ahead, give it a whirl, and take control of your finances with a few taps on your screen. You might just find yourself wondering how you managed without it.

Screenshots