CreditWise from Capital One

4.6 Finance Updated January 7th, 2026

Have you ever found yourself questioning your credit score? Perhaps you’re just like me, always on the lookout for ways to keep tabs on your financial health without spending a dime. Well, let me introduce you to CreditWise from Capital One, a nifty app that’s got your back when it comes to managing and understanding your credit score.

Discovering CreditWise: A Peek into Its Features

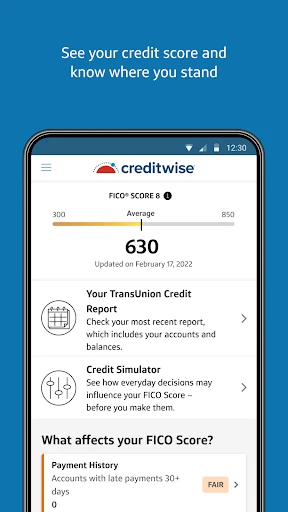

Right off the bat, what I love about CreditWise is how it offers a user-friendly interface that makes checking your credit score feel like a walk in the park. The app is designed with simplicity in mind, meaning you don’t need to be a financial guru to navigate it. Just a few taps, and voila! You’re in the know.

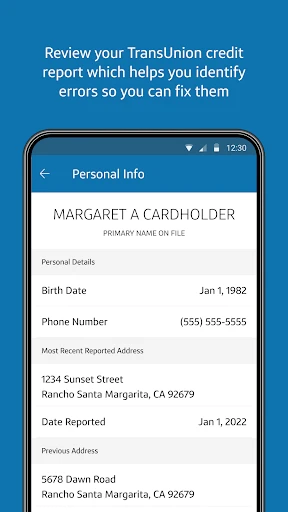

One of the standout features is the ability to access your TransUnion credit score and VantageScore 3.0 for free. Yes, you read that right—free! And before you ask, no, you don’t need to be a Capital One customer to take advantage of this. The app provides weekly updates, which is perfect for those of us who are a bit obsessed with keeping our financial ducks in a row.

Keeping Your Finances in Check

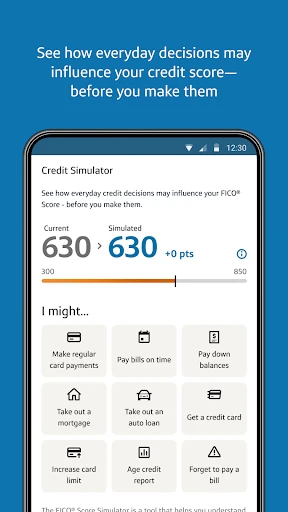

Besides offering a free credit score, CreditWise also provides a credit simulator. This tool is a game-changer for anyone curious about how different financial decisions might affect their score. Wondering what would happen if you paid off a loan or opened a new credit card? The simulator lets you play out these scenarios without any real-world consequences.

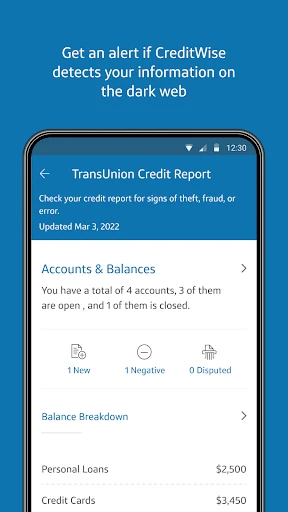

Moreover, the app’s dark web monitoring is a feature that adds an extra layer of security. In this digital age, identity theft is a real concern, and knowing that CreditWise has its digital eyes peeled for any suspicious activity tied to your identity is reassuring.

Wrapping Up: My Final Thoughts

So, what’s the bottom line on CreditWise? It’s a robust tool for anyone eager to get a grip on their credit score without breaking the bank. It’s got all the bells and whistles you’d expect, plus a few extras that make it stand out in a crowded app market. Whether you’re a credit newbie or a score-savvy pro, CreditWise offers something for everyone.

In a world where financial literacy is more important than ever, having a tool like CreditWise at your fingertips is invaluable. So, why not give it a whirl? You might just find it’s the app you never knew you needed.

Screenshots