Credit Sesame: Grow your score

4.7 Finance Updated January 7th, 2026

Have you ever found yourself scratching your head, wondering why your credit score isn't as high as you'd like it to be? Well, that's where Credit Sesame comes into play. I recently tried this app out, and let me tell you, it's like having a personal finance guru right in your pocket. So, let’s dive into what makes Credit Sesame a must-have tool for anyone looking to boost their credit score.

Unpacking the Features

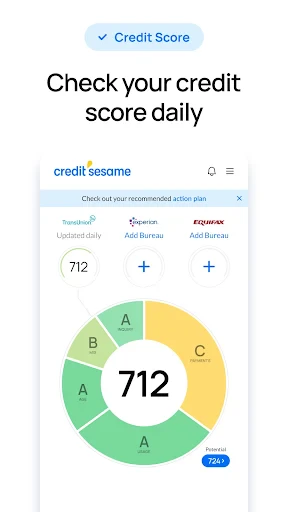

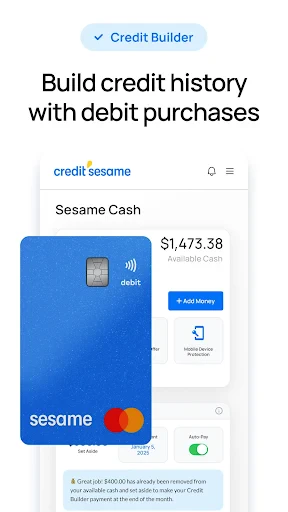

As soon as I opened the app, I was greeted with a user-friendly interface. It's super intuitive, which is a breath of fresh air compared to other finance apps I've tried. The dashboard is clean, and all the important information is right there at your fingertips. You can easily view your credit score, outstanding debts, and even your credit utilization rate.

Credit Monitoring and Alerts

One of the standout features is the real-time credit monitoring. The app keeps tabs on your credit score and sends you alerts whenever something changes. I remember getting a notification about a hard inquiry on my credit report. It's like having a watchdog that never sleeps, which puts my mind at ease.

Personalized Recommendations

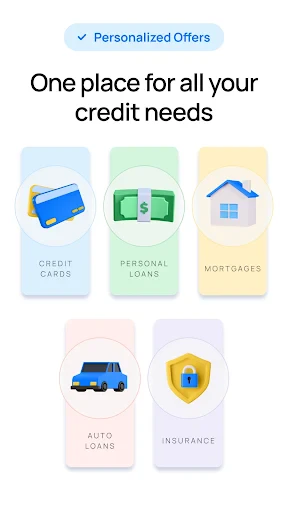

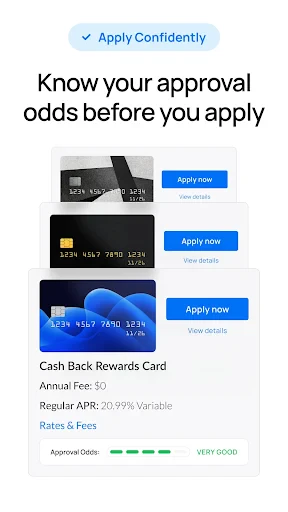

Another feature that I absolutely love is the personalized recommendations. Based on your credit profile, the app suggests ways to improve your score. Whether it's opening a new line of credit or paying down existing debts, the advice is tailored just for you. It's like having a financial advisor who knows you inside and out.

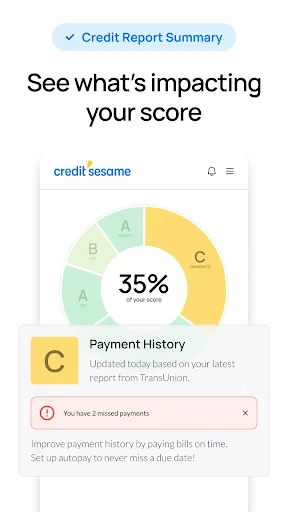

Free Credit Report Card

And let's not forget the free credit report card. This nifty feature breaks down the factors affecting your score, like payment history and credit age. It’s incredibly detailed and gives you a clear picture of where you stand. Plus, it’s free! Who doesn’t love free stuff?

What really sets this app apart is its focus on empowering users. Credit Sesame offers a host of educational resources to help you understand the ins and outs of credit scores. From blog posts to video tutorials, the app is jam-packed with information to help you become a credit whiz.

Final Thoughts

If you're serious about improving your credit score, then look no further than Credit Sesame. It's a comprehensive tool that offers everything from credit monitoring to personalized advice. It's like having a financial advisor available 24/7, without the hefty price tag.

Honestly, I can't think of a reason not to give it a try. It's free to download, so you've got nothing to lose and a higher credit score to gain. Go ahead, take the plunge and watch your credit score soar!

Screenshots