Cleo AI: Cash advance & Credit

4.4 Finance Updated January 7th, 2026

If you find budgeting as fun as watching paint dry, hang on tight because Cleo AI is here to turn your financial life around! I’ve had the chance to dive into this app, and let me tell you, it’s like having a sassy financial advisor in your pocket, minus the hefty fees.

Meet Cleo: Your New Financial BFF

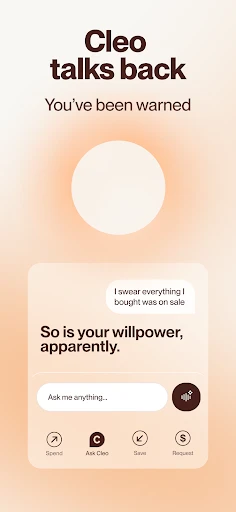

Cleo AI is not just any budgeting app; it’s a lively chatbot that makes managing money feel less like a chore and more like a conversation with a friend. Once you set it up, Cleo gets straight to business, analyzing your spending habits and offering insights that are both helpful and hilariously on point. It's like having someone who knows when to give you a pat on the back or a cheeky nudge when you're about to blow your budget on yet another takeout meal.

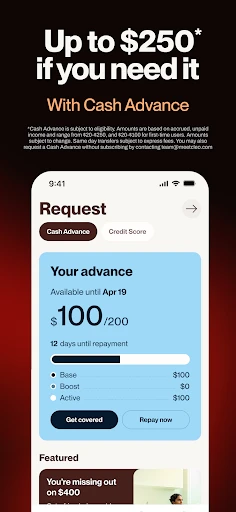

Cash Advances at Your Fingertips

One of the standout features of Cleo is its cash advance service. Picture this: it’s the end of the month, and you’re scraping by until payday. Cleo swoops in, offering a cash advance to tide you over. It’s quick, easy, and doesn’t come with the eye-watering interest rates you’d expect from traditional lenders. It’s a lifesaver for those "just in case" moments.

Credit Score Insights

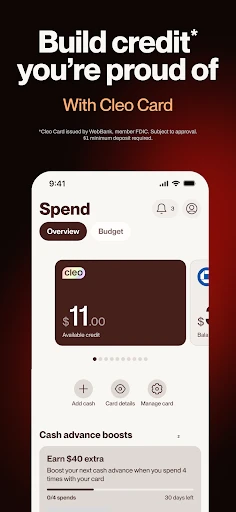

Cleo doesn’t stop at just handling your daily finances; it also cares about your credit health. The app provides a clear breakdown of your credit score and tips to improve it. It’s like having a financial coach cheering you on as you climb the credit ladder. This feature is a game changer for anyone looking to understand and boost their credit score without the usual financial jargon that makes your head spin.

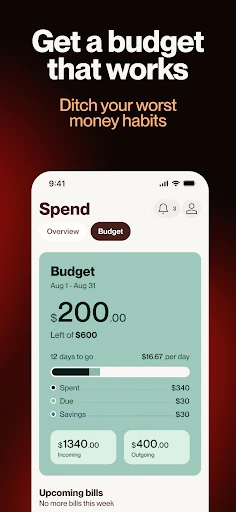

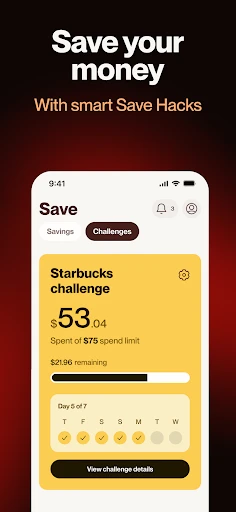

Budgeting with a Twist

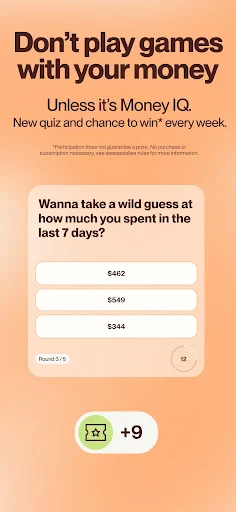

Budgeting apps are everywhere, but Cleo stands out with its interactive and sometimes cheeky interface. You can set budgets, track spending across different categories, and even set savings goals. The twist? Cleo’s interactive approach makes the process feel less like a lecture and more like a pep talk. It’s refreshing, engaging, and keeps you coming back for more.

Security and Privacy

In today’s digital age, security is a top priority, and Cleo takes it seriously. The app uses bank-level encryption to keep your data safe and sound. Plus, it doesn’t store sensitive information, which adds an extra layer of peace of mind as you navigate your financial journey.

So, there you have it: Cleo AI, the app that’s transforming the way we manage money. It’s perfect for anyone looking to take control of their finances without the stress and confusion that usually comes with the territory. Whether you need a little extra cash, want to improve your credit score, or just need a budgeting buddy, Cleo is ready to jump in and help. Give it a try and see if it’s the financial friend you never knew you needed!

Screenshots