Classic Netspend

4.6 Finance Updated January 7th, 2026

Have you ever found yourself juggling multiple financial tools, trying to keep track of your spending, savings, and budgeting all in one go? Well, let me introduce you to something that might just streamline your financial life: the Classic Netspend app. I recently gave it a whirl, and here's what I found.

Getting Started with Classic Netspend

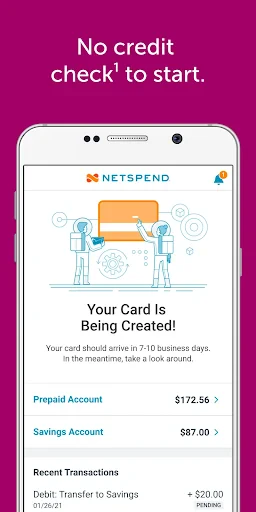

First off, downloading and setting up Classic Netspend was a breeze. Available for both Android and iOS, the app is designed to help manage your finances with ease. Once you download it, the registration process is straightforward, requiring some basic information to get started. The interface is quite user-friendly, which means you don’t have to be a tech wizard to navigate through it.

Features That Make a Difference

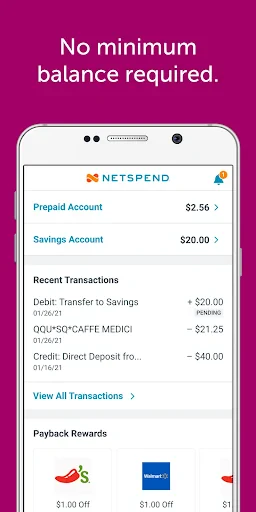

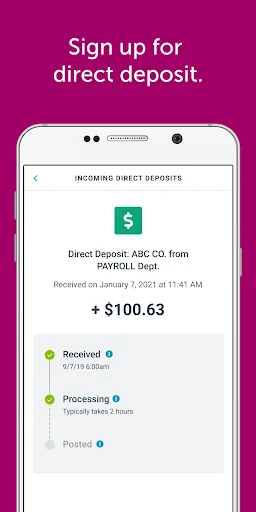

Now, onto the features. What I particularly liked about Classic Netspend is its ability to function as a one-stop financial hub. You can easily track your spending, manage your budget, and even reload your prepaid card directly from the app. It’s like having a mini-bank right in your pocket. One of the standout features is the ability to receive alerts for transactions, which adds an extra layer of security and peace of mind.

Moreover, the app offers a handy budgeting tool. This feature allows you to categorize your spending and set limits, helping you stay on top of your finances without breaking a sweat. Plus, the real-time transaction history means you can see where your money is going at any given moment.

User Experience and Performance

As for the user experience, it’s overall quite positive. The app runs smoothly, with minimal lag or hiccups. Navigating from one section to another is seamless, and the design is aesthetically pleasing without being overly complicated. It’s clear that a lot of thought has gone into making this app both functional and easy to use.

Another point worth mentioning is the customer support. If you ever run into issues, Netspend offers solid support options. Whether you prefer chatting online or speaking to someone over the phone, help is readily available, which is a huge plus in my book.

Final Thoughts

In conclusion, if you’re looking for a reliable way to manage your finances on the go, Classic Netspend is definitely worth considering. It combines functionality with ease of use, making it a fantastic option for anyone needing a financial management tool. Whether you’re tech-savvy or just dipping your toes into the digital finance world, this app caters to all levels.

So, why not give it a try? It might just be the financial sidekick you’ve been searching for. Happy banking!

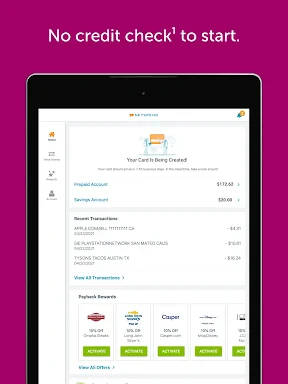

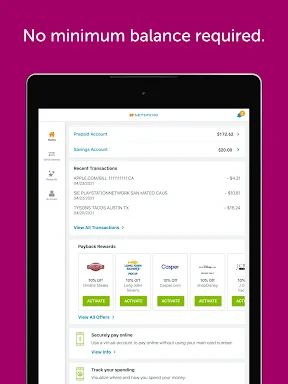

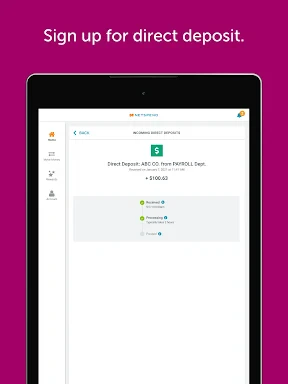

Screenshots