Brigit: Cash Advance & Credit

4.8 Finance Updated January 7th, 2026

Hey there, fellow app explorer! Today, I'm diving into the world of personal finance with Brigit: Borrow & Build Credit. If you're like me and sometimes find managing money a bit overwhelming, this app might just be the lifesaver we need. Let's see what Brigit has to offer and if it lives up to the buzz!

Brigit at a Glance

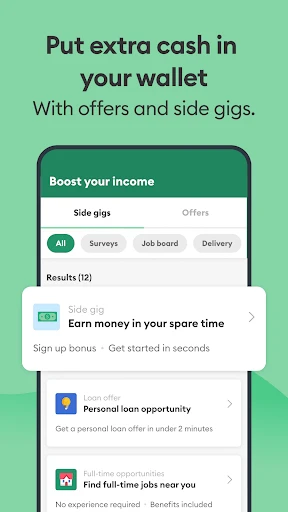

Brigit is designed to be your personal financial assistant, helping you navigate the tricky waters of budgeting, borrowing, and building credit. Available on both Android and iOS, this app promises to offer financial insights and tools to prevent overdrafts, improve your credit score, and even provide cash advances when you're in a pinch.

Getting Started

Setting up Brigit is a breeze. After downloading the app, you’ll need to link it to your bank account, which allows Brigit to analyze your spending habits. Don’t worry, it’s super secure! The app uses bank-level security to protect your data. Once linked, Brigit gives you a comprehensive overview of your finances, and the insights begin almost immediately.

Features Worth Highlighting

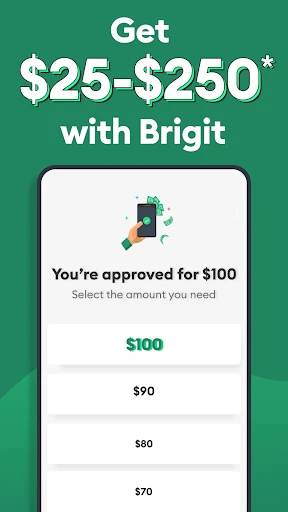

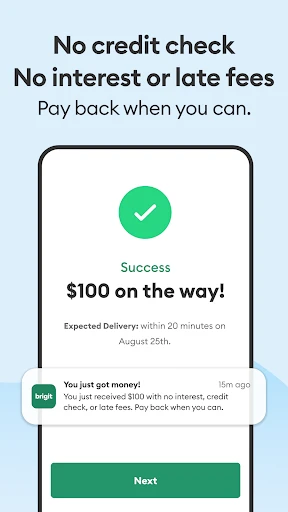

The standout feature for me has to be the instant cash advance. We've all been there – a few days before payday and something unexpected pops up. Brigit offers up to $250 to help you out, with no interest or hidden fees. It’s like having a safety net in your pocket!

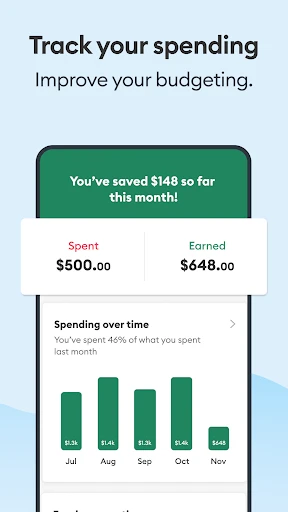

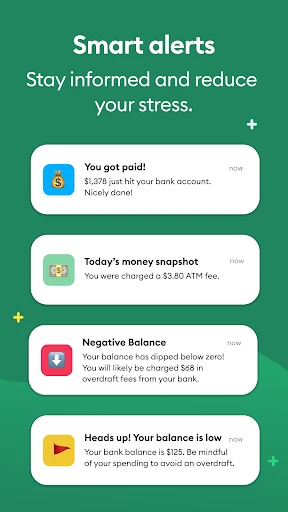

Another cool feature is the credit builder. If you're trying to improve your credit score, Brigit’s credit builder plan reports your payments to major credit bureaus, helping you build a positive credit history over time. Plus, the app's budgeting tools are pretty intuitive. You can set spending limits, track your expenses, and even get alerts to avoid overdrafts.

Real-Life Impact

What I love about Brigit is how it feels like a genuine helping hand rather than just another app cluttering my phone. The predictive algorithms are quite accurate, often alerting me to potential financial pitfalls before I even realized they existed. It’s like having a financially savvy friend giving you advice 24/7!

From personal experience, the app has helped me avoid a few overdrafts, saving me those pesky fees. The peace of mind that comes with knowing you have a backup plan is invaluable. Plus, seeing my credit score gradually improve has been a satisfying experience.

Final Thoughts

All in all, Brigit is more than just a financial app; it’s a financial companion. Whether you’re trying to build credit, need a safety net to avoid overdraft fees, or just want a better handle on your budget, Brigit offers practical solutions in a user-friendly package.

While it might not replace a comprehensive financial advisor, for everyday use, it’s pretty stellar. So, if you're looking for a way to manage your finances more effectively, Brigit is definitely worth a try. Give it a whirl and see how it can change your financial game!

Screenshots