BMO Digital Banking

4.6 Finance Updated January 7th, 2026

Hey there! So, today I’m diving into the world of BMO Digital Banking. If you’re like me, managing finances on the go is crucial, and having a reliable app to do that is a game-changer. Let’s see if this app delivers what we all need in our fast-paced lives.

Getting Started with BMO Digital Banking

First things first, downloading the BMO Digital Banking app is a breeze. Available on both Android and iOS, it’s just a quick search away on your app store. What I love about it is the straightforward setup. You just need your banking details handy, and boom, you’re in! No more endless forms or waiting in line at the bank. It’s like having a mini bank in your pocket.

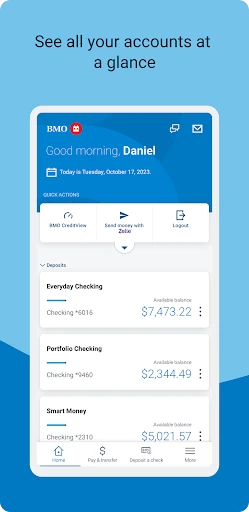

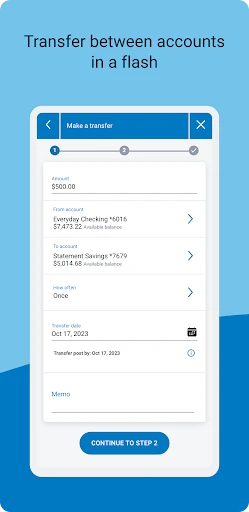

User-Friendly Interface

Let’s talk about the interface. One word: intuitive. The developers have nailed it by making everything accessible with just a few taps. Whether you’re checking your balance, transferring funds, or paying bills, it’s all laid out in a way that feels natural. Even if you’re not tech-savvy, navigating through this app feels like a walk in the park.

Features That Stand Out

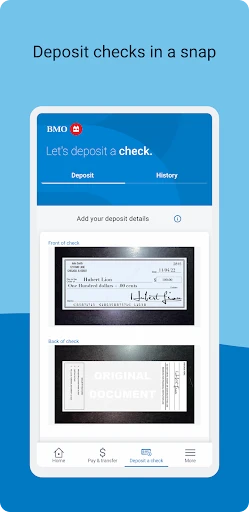

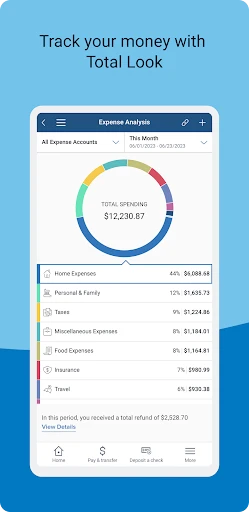

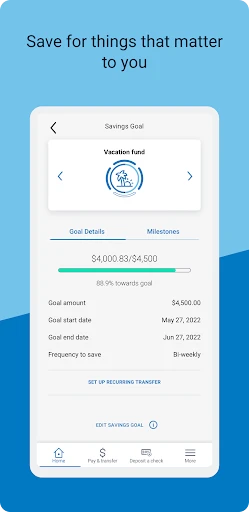

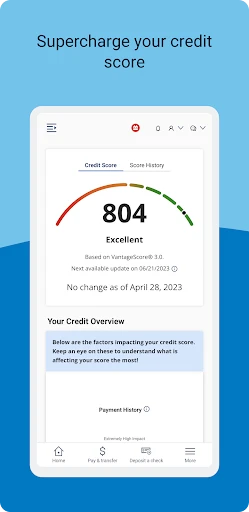

Now, onto the features. One of my favorites is the real-time notifications. You get updates on transactions as they happen, which adds an extra layer of security and peace of mind. Plus, the budgeting tools are a nice touch. They help track your spending habits and set financial goals without needing a separate app. Oh, and did I mention the mobile check deposit? It’s a lifesaver, especially when you just can’t make it to a branch.

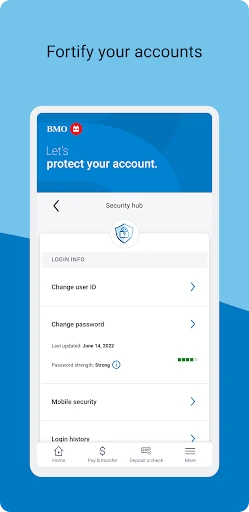

Security-wise, the app doesn’t skimp. It uses advanced encryption to keep your data safe, which is a huge relief. And if you’re ever in a pinch, their customer support is just a call away, ready to help iron out any issues.

Final Thoughts

In conclusion, BMO Digital Banking is a solid choice for anyone looking to manage their finances efficiently. It combines convenience with a robust set of features that make banking less of a chore and more of a seamless part of your day. While no app is perfect, this one comes pretty close, ticking most of the boxes that modern users look for.

So, if you’re in the market for a banking app that keeps up with your lifestyle, give this one a shot. You might just find it becomes an essential part of your financial toolkit!

Screenshots