B9: Cash Advance・Banking・Earn

4.2 Finance Updated January 7th, 2026

Have you ever found yourself in a tight spot, waiting for payday to come around? Well, let me introduce you to B9: Cash Advance・Banking・Earn, a nifty little app that promises to save the day when you're in a financial pinch. I gave it a whirl to see if it lives up to the hype, and here's my take on it.

Getting Started with B9

First things first, installing B9: Cash Advance・Banking・Earn is a breeze. Available on both Android and iOS, the app’s interface is sleek and user-friendly, making it accessible even for those who aren't tech-savvy. Once you’re in, setting up your account is straightforward – you’ll need to link your bank account, which might raise an eyebrow or two, but rest assured, the process is secure and compliant with banking standards.

Features that Stand Out

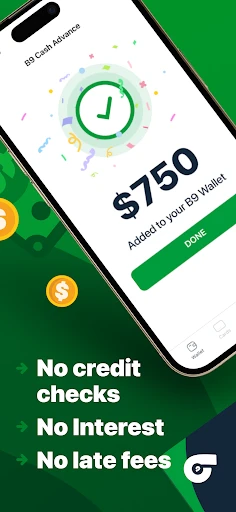

Now, let's talk about what makes B9 stand out in the crowded marketplace of finance apps. One of the main features is the cash advance service. Essentially, it allows you to access a portion of your paycheck before your actual payday. For anyone who’s been in a bind, waiting for that next paycheck, this feature can feel like a lifesaver. Plus, the app doesn’t charge any interest on these advances, which is a huge relief compared to traditional payday loans that can drown you in fees.

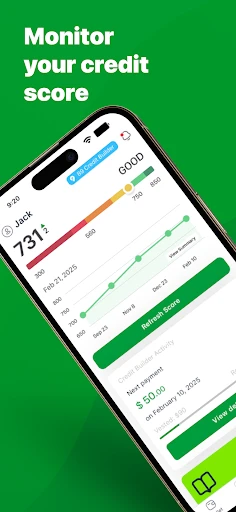

Apart from that, B9 acts as a full-fledged banking app. You can manage your finances, track spending, and even set up direct deposits. It's like having a bank in your pocket, minus the long queues and paperwork. And oh, did I mention the budgeting tools? They’re quite handy if you’re trying to keep tabs on your spending habits.

Real-life Benefits

Using B9 in real life can truly be a game-changer. For instance, imagine you’ve got an unexpected car repair bill, and payday is still a week away. Instead of stressing about how to cover the costs, you can simply use B9 to get a cash advance. It’s quick, easy, and most importantly, doesn’t take a toll on your credit score.

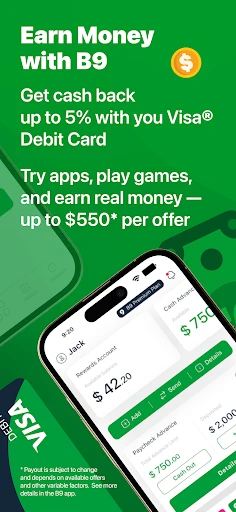

In addition, the app rewards you with cash back on purchases, which is a nice little bonus. These small perks can add up over time, especially if you’re using the app regularly for your banking needs.

Final Thoughts

All in all, B9: Cash Advance・Banking・Earn is a solid app for anyone looking to manage their finances more effectively or for those who need a safety net between paychecks. It’s packed with features that are not only useful but also financially savvy. Whether it’s the cash advance, banking facilities, or the budgeting tools, B9 covers all bases.

So, would I recommend B9? Absolutely. If you’re someone who occasionally finds themselves in need of a quick financial boost or just wants a reliable banking app, give B9 a try. You might just find it’s the financial companion you never knew you needed.

Screenshots