Atlas - Rewards Credit Card

4.6 Finance Updated January 7th, 2026

Have you ever wondered if there's a credit card app that doesn’t just help you manage your finances but rewards you for doing so? Well, look no further because the Atlas - Rewards Credit Card app might just be what you’ve been searching for. I’ve taken this app for a spin, and I’m excited to share my experience with you.

Getting Started with Atlas

When you first download the Atlas app, you’re greeted with a sleek and intuitive interface that makes setting up your account a breeze. The sign-up process is straightforward. You just need to input some basic information, and you’re good to go. What I particularly enjoyed was the app's user-friendly design which makes navigation feel like a walk in the park, even if you’re not tech-savvy.

Features That Stand Out

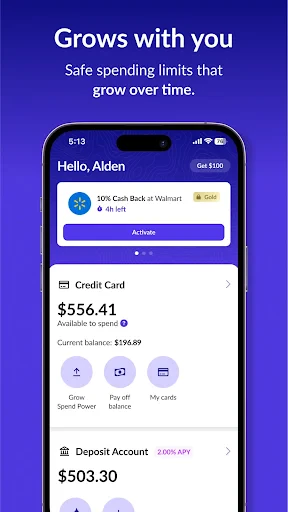

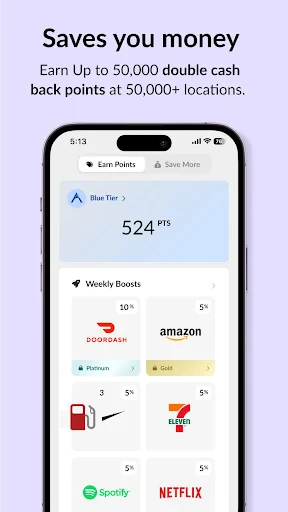

One of the standout features of the Atlas app is its rewards system. Unlike traditional credit cards that offer points or cashback on specific categories, Atlas provides a more flexible rewards program. You earn points on every purchase, and these points can be redeemed for a variety of rewards, from travel vouchers to gift cards. It’s like having a little bonus every time you spend!

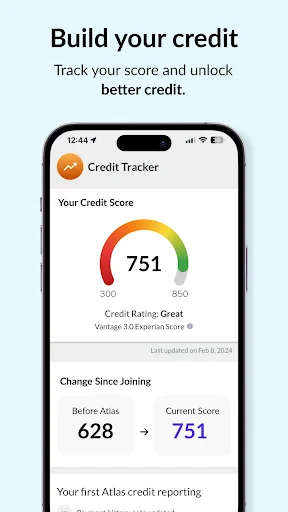

Another feature worth mentioning is the financial insights tool. This feature offers a detailed breakdown of your spending habits, helping you identify areas where you can save money. It’s almost like having a personal financial advisor in your pocket. Plus, the app sends you alerts on upcoming bills and payment deadlines, so you never miss a due date.

Security and Convenience

Security is a big deal when it comes to managing your finances, and Atlas doesn’t disappoint. The app uses advanced encryption to protect your data, and you can enable biometric authentication for an extra layer of security. I also appreciate the virtual card feature, which allows you to shop online without exposing your actual card details.

On the convenience front, the app supports integration with other financial tools and allows you to set up automatic payments, ensuring that your bills are paid on time. The transaction notifications keep you updated on your spending in real-time, which is a bonus for those who like to keep a tight rein on their finances.

My Final Take

All in all, the Atlas - Rewards Credit Card app offers a comprehensive solution for those looking to manage their finances while reaping rewards. It’s user-friendly, packed with useful features, and provides excellent security measures to keep your data safe. If you’re in the market for a new credit card app, I’d definitely recommend giving Atlas a try. It’s not just a financial tool; it’s a financial companion that makes managing money a rewarding experience.

Screenshots