Ally: Bank, Auto & Invest

4.4 Finance Updated January 7th, 2026

Let me tell you all about my experience with Ally: Bank, Auto & Invest, an app that promises to streamline your financial life into one neat package. I’ve been dabbling around with it, and here’s my take on how it rolls.

Banking Made Easy

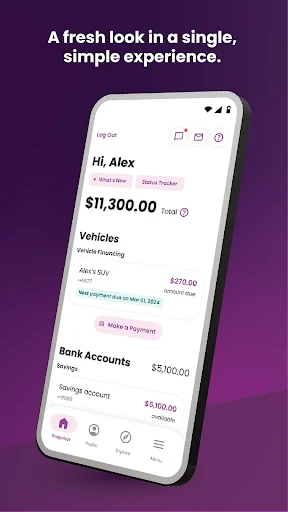

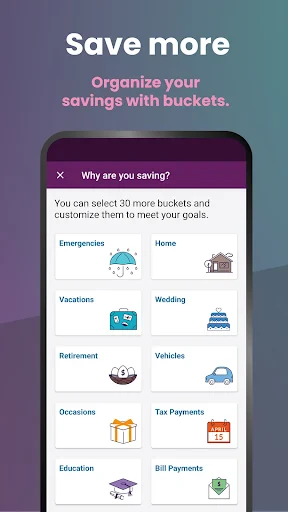

First off, the banking feature is something to write home about. Whether you’re checking balances or transferring funds, it’s all done with a few taps. Seriously, I’ve been able to handle my finances in a jiffy, all thanks to its intuitive design. The app’s layout is clear, and it doesn’t bombard you with unnecessary info. Plus, the security measures are top-notch, which is always a biggie for me.

Auto Financing on the Go

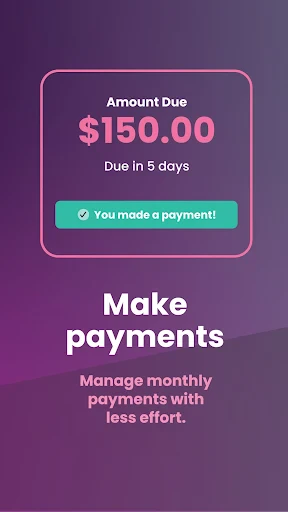

Now, if you’re like me and you dread anything to do with auto loans, Ally: Bank, Auto & Invest might just change your mind. Their auto financing feature is surprisingly user-friendly. From calculating payments to managing your loan, it’s all there and super accessible. I even found myself enjoying the process, which is saying a lot!

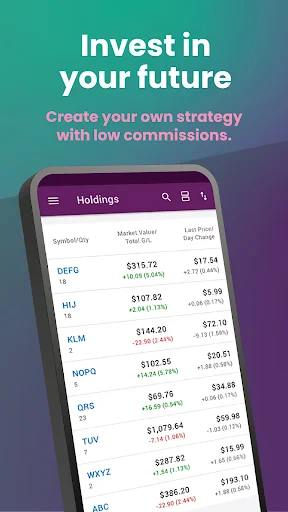

Investments Simplified

Then there’s the investing part. I’m no Wall Street wizard, but the investment tools here are so easy to navigate that I actually feel like I know what I’m doing. Whether you’re a newbie or a seasoned investor, this app has got you covered. It provides insights and recommendations that are actually useful, not just jargon-filled nonsense.

And the best part? You can manage all these features without jumping through hoops. The app is genuinely designed to make your life easier, not more complicated.

"A one-stop-shop for all your financial needs with a user-friendly interface."

Overall, Ally: Bank, Auto & Invest is a fantastic tool for anyone looking to keep their financial matters under one roof without any hassle. It’s reliable, secure, and incredibly straightforward to use. Whether you’re banking, financing your vehicle, or investing for your future, this app makes it all seem less daunting and more accessible.

If you’ve been on the fence about using a mobile app for your financial needs, give this one a try. It just might be the ally you’ve been looking for in managing your money!

Screenshots