Albert: Budgeting and Banking

4.5 Finance Updated January 7th, 2026

Albert: Budgeting and Banking is like having a financial wizard right in your pocket. Seriously, if you’ve ever felt overwhelmed by managing your finances, this app is about to become your new best friend. I downloaded it a few weeks ago, and it’s been a game-changer! Let’s dive into what makes Albert stand out from the crowd.

Meet Albert: Your Personal Finance Guru

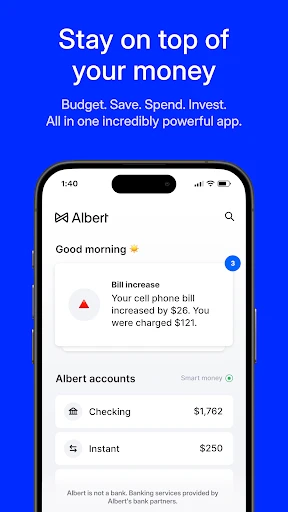

First off, Albert isn’t just any budgeting app. It’s designed to be an all-in-one financial assistant. When I first opened the app, I was greeted by a clean and intuitive interface that made setting up my account a breeze. Right from the get-go, Albert integrates with your bank accounts, credit cards, and bills. This means no more manual entry of transactions, which is a huge time-saver!

Simplified Budgeting

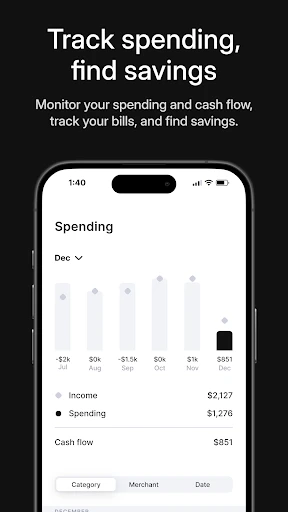

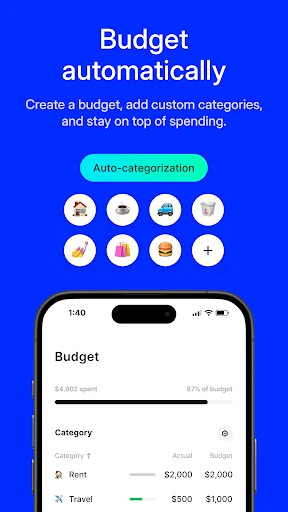

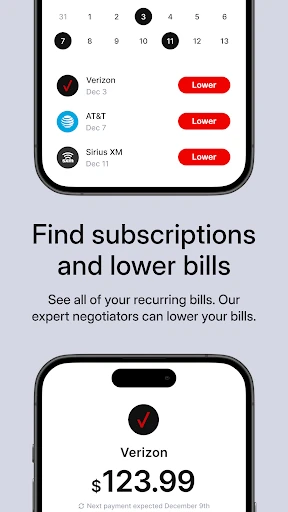

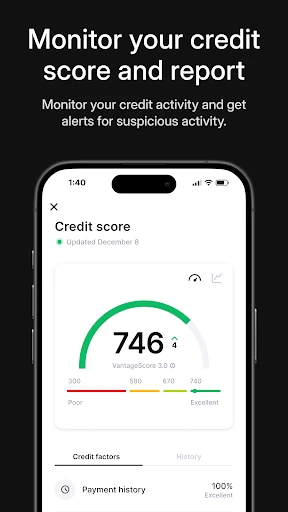

The budgeting feature is where Albert truly shines. The app automatically categorizes your spending and gives you a clear picture of where your money is going. I was surprised at how insightful the spending reports were! It even nudged me to cut back on those daily coffee runs. Plus, the app sets up a personalized budget for you, making it super easy to see where you can save a few bucks.

Albert Genius: Real-Time Advice

One of the standout features is the "Albert Genius" service. It’s like having a financial advisor on speed dial. I had a couple of questions about saving strategies, and within minutes, I was chatting with a financial expert. They provided tailored advice that felt personal and relevant to my financial situation. It’s this hands-on approach that makes Albert more than just an app; it’s a financial partner.

Savings Made Effortless

Saving money can sometimes feel like a daunting task, but Albert makes it surprisingly easy. The app has an automatic savings feature that intelligently analyzes your spending patterns and tucks away small amounts of money. I didn’t even notice the small transfers happening, but I was pleasantly surprised by the savings I accumulated over just a few weeks. It’s like the app is secretly building a savings cushion for you!

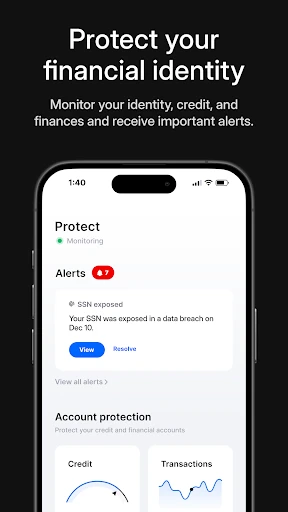

Security and Peace of Mind

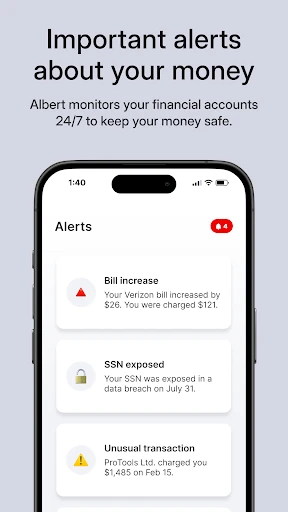

Now, I know what you might be thinking: is it safe? The app uses bank-level security to protect your information, so I felt confident linking my accounts. Plus, all data is encrypted, and they have a strict privacy policy. It’s essential to feel secure when dealing with finances, and Albert does a great job at providing that peace of mind.

Overall, Albert: Budgeting and Banking has transformed the way I handle my finances. It’s user-friendly, offers personalized advice, and makes saving money effortless. Whether you’re a budgeting beginner or a seasoned pro, this app is worth checking out. Trust me, your wallet will thank you!

Screenshots