Zip - Buy Now, Pay Later

4.8 Shopping Updated January 7th, 2026

If you're like me and love to shop without the immediate hit to your wallet, then Zip - Buy Now, Pay Later might just be your new best friend. Picture this: You're eyeing that snazzy pair of sneakers or the latest gadget, but payday is still a week away. What do you do? This is where Zip - Buy Now, Pay Later swoops in to save the day.

Shopping Freedom with Zip

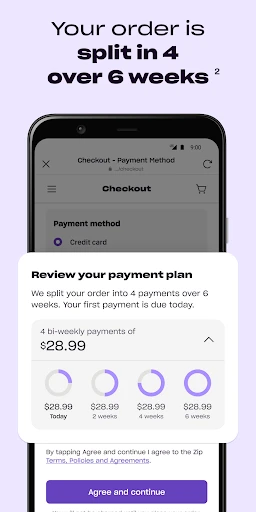

So, what exactly is Zip? Well, it's a nifty little app that lets you snag your favorite items now and worry about the payments later. Basically, it splits your purchase into four easy installments over six weeks. No upfront payment, no interest, just pure shopping bliss. You can shop at thousands of stores, both online and in-store, making it super versatile. And the best part? You don’t need a credit card!

How It Works

Using Zip is as easy as pie. First, download the app from the App Store or Google Play. Once you've got it installed, sign up and link your debit card. Now, you’re ready to shop. When you’re checking out, select Zip as your payment method. Your first payment will be due at the time of purchase, with the remaining three payments automatically deducted from your linked account every two weeks. It’s like having a financial buddy who’s got your back when you need it most.

Why I Love Zip

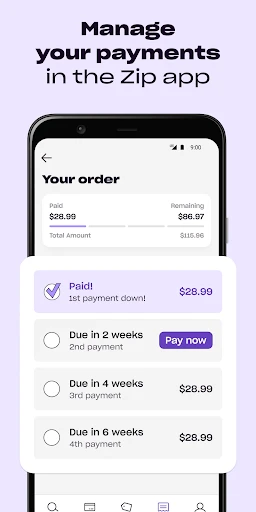

One of the things I adore about Zip is the flexibility it offers. You can keep track of all your purchases and payment schedules right in the app. It even sends you reminders so you never miss a payment. Plus, there are no hidden fees, which is a huge relief in a world where unexpected charges seem to pop up everywhere. Budget management becomes a breeze, and that’s something we can all appreciate.

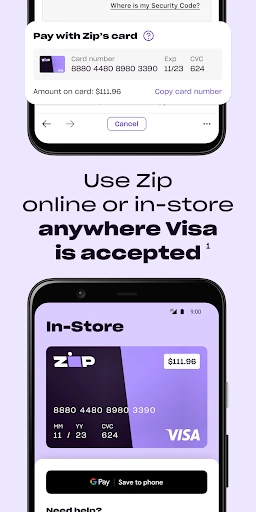

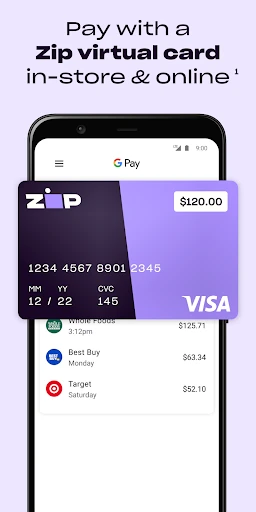

Another fantastic feature is the virtual card option. You can use this to shop at any store that accepts Visa, both online and offline. It’s like having a magic card that lets you buy now and pay later, almost anywhere. I’ve used it for everything from clothes to concert tickets, and it’s been a game-changer.

A Few Tips

Now, while Zip is a great tool, it’s important to use it wisely. Always keep track of your spending and ensure you have enough funds in your account to cover the payments. Remember, it’s not free money, but a way to manage your expenses more conveniently. Also, keep an eye out for special promotions and discounts available through the app. It’s a great way to save even more while you shop.

So, if you’re looking to shop smart and stay within budget, give Zip a try. It’s like having a personal financial assistant in your pocket. Happy shopping!

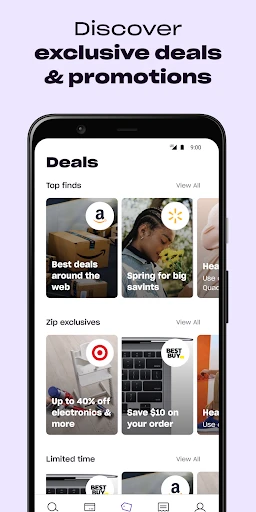

Screenshots