PayPal POS (ex Zettle)

3.6 Business Updated January 7th, 2026

When it comes to managing transactions, especially in the fast-paced environment of small to medium-sized businesses, having a reliable Point of Sale (POS) system is crucial. Enter PayPal POS (formerly known as Zettle), which aims to simplify the payment process while offering a host of features designed to streamline your business operations. As someone who's constantly on the lookout for efficient solutions, I decided to give this app a whirl and here’s what I found.

First Impressions and Setup

Kicking off my experience with PayPal POS, I was pleasantly surprised by how straightforward the setup was. After downloading the app from the Android or iOS store, the installation was a breeze. I was up and running in no time. The app provides a very intuitive interface, which is a big plus if you're not particularly tech-savvy. I found it easy to navigate through the initial setup, linking my PayPal account, and configuring my inventory. The step-by-step guidance ensures that even beginners can get started without a hitch.

Features That Stand Out

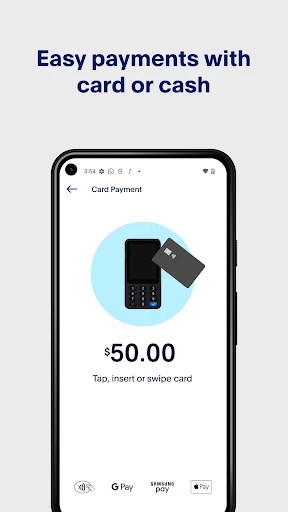

What I really appreciate about PayPal POS is its versatility. Whether you're running a brick-and-mortar store or popping up at a market, this app adapts beautifully. The ability to accept multiple forms of payment—be it credit cards, debit cards, or contactless options—means you won't miss out on a sale because you couldn't accommodate a customer's preferred payment method. And let's not forget the app's offline mode, which ensures you can continue processing sales even without an internet connection. That’s a lifesaver for businesses on the go!

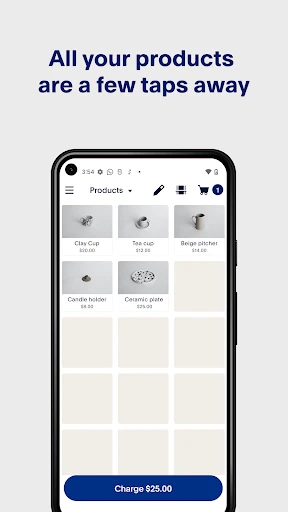

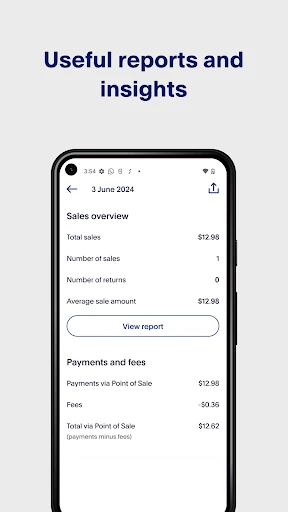

The inventory management feature is another highlight. Keeping tabs on stock levels in real-time is crucial, and with this app, updating and tracking products is as simple as a few taps on the screen. It even offers sales analytics, which I found particularly useful for gaining insights into customer behavior and identifying top-selling items. It’s like having a personal business analyst right in your pocket.

Customer Experience and Usability

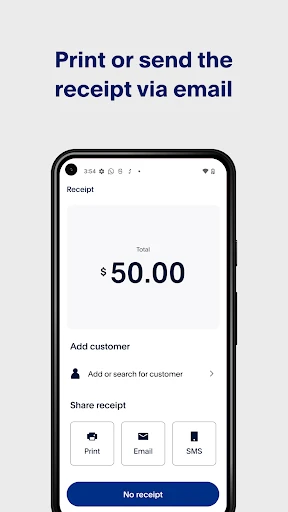

From a customer's perspective, the checkout process is seamless. The interface is clean and simple, which speeds up the transaction process and reduces wait times. This is particularly important during peak business hours when every second counts. Additionally, the app supports digital receipts, which not only saves paper but also provides customers with a convenient way to keep track of their purchases.

Usability-wise, the app is designed with both the business owner and the customer in mind. The straightforward design means less time training staff and more time focusing on growing your business. Plus, the integration with PayPal's ecosystem provides an added layer of trust and security, something that’s incredibly important in today’s digital age.

Final Thoughts

After spending some time with PayPal POS, it’s clear that this app is a powerhouse for any business looking to streamline their sales process. The ease of use, coupled with its robust features, makes it a worthy contender in the POS market. It’s not just about processing payments; it’s about enhancing the entire business operation. Whether you’re a seasoned entrepreneur or just starting out, this app could very well be the tool you need to take your business to the next level. So, if you're in the market for a reliable POS system, give PayPal POS a try—you won't be disappointed.

Screenshots