PayPal Business

3.9 Business Updated January 7th, 2026

Alright, folks, let's dive into the world of PayPal Business, an app that's been making waves in the business community for a while now. If you're like me, juggling multiple payment methods and trying to keep track of all the transactions can be a bit of a headache. Enter PayPal Business, a handy tool that promises to simplify your business dealings. But does it live up to the hype? Let's find out.

The Set-Up: Easy Peasy or a Tough Nut to Crack?

First things first, getting started with PayPal Business is a breeze. The app is available for both Android and iOS, so no worries about compatibility. You just download it from your app store, and voilà, you're ready to roll. The sign-up process is straightforward, requiring just a few details about your business and a verification step to ensure everything's legit.

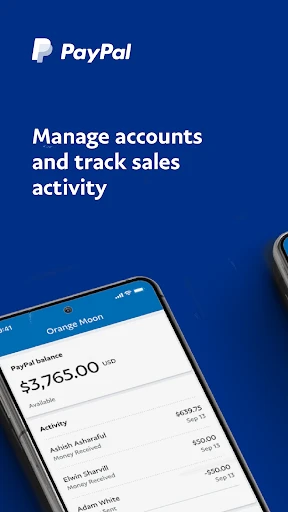

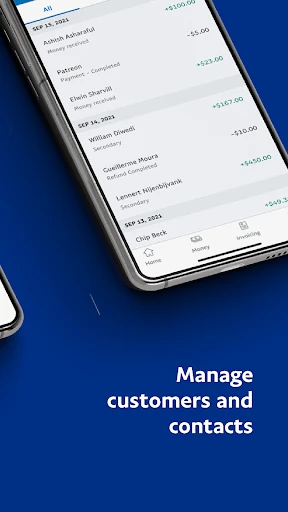

Once you're in, the interface is pretty intuitive. Everything's laid out in a way that makes sense, so even if you're not the most tech-savvy person out there, you won't have much trouble navigating through it. The dashboard gives you a neat overview of your sales and transactions, which is super handy for those of us who like to keep an eye on the numbers.

Features That Make You Go "Wow"

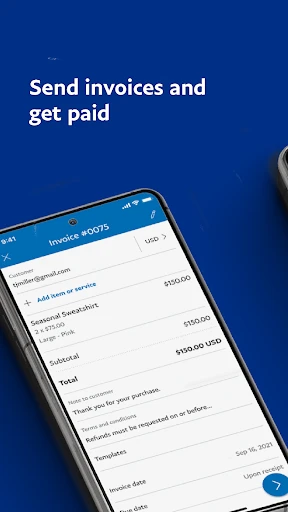

Now, let's talk features. PayPal Business isn't just about sending and receiving payments; it's like having a miniature financial advisor right in your pocket. You've got invoicing tools, which let you create and send invoices directly from the app, complete with your business logo and all the necessary details. This feature alone is a game-changer for freelancers and small business owners who want to maintain a professional image.

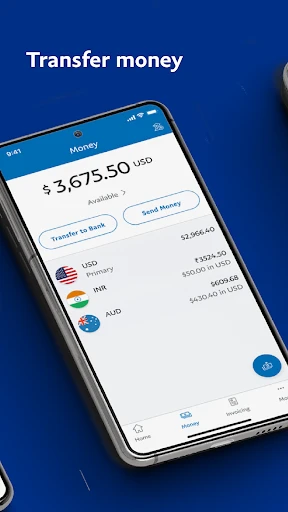

Another cool feature is the ability to accept multiple currencies. If you're dealing with international clients, this is a godsend. You can accept payments in various currencies without breaking a sweat. Plus, the app provides insights into your cash flow, helping you make informed decisions about your business finances.

Security and Reliability: Can You Trust It?

Security is a big deal, especially when it comes to handling money. Thankfully, PayPal Business takes this seriously. The app uses advanced encryption technology to keep your data safe. Plus, it offers seller protection for eligible sales, which means you can rest easy knowing that PayPal has your back in case of any disputes.

In terms of reliability, PayPal is a name that's been around for years, and it's trusted by millions of users worldwide. The app runs smoothly, with minimal downtime, so you can focus on running your business without any hiccups.

The Final Verdict: Is It Worth It?

So, what's the bottom line? If you're a business owner looking for a reliable, versatile, and user-friendly payment solution, PayPal Business is definitely worth considering. It combines the convenience of digital payments with robust features that cater to the needs of small to medium-sized businesses.

While it might not be perfect for every business model out there, for the majority of us who need a straightforward way to manage transactions and keep our financial ducks in a row, this app is a solid choice. So go ahead, give it a whirl, and see how it can streamline your business operations. You might just wonder how you ever managed without it!

Screenshots