Minute Money

4.1 Lifestyle Updated January 7th, 2026

Ever wondered what it feels like to have a personal finance assistant right in your pocket? Well, with the "Minute Money" app, your financial dreams might just get a little more tangible. Let me walk you through my experience with this nifty little app that's shaking up the finance management scene.

Getting Started with Minute Money

Diving into Minute Money was like opening a treasure chest of financial insights. Setting up the app was a breeze – a few taps here, a couple of permissions there, and voila! You're in. The interface welcomes you with a clean design that's as easy on the eyes as it is to navigate. Trust me, even if you're not a tech whiz, you'll get the hang of it in no time.

Tracking Your Expenses

The real magic of Minute Money lies in its ability to track expenses meticulously. Whether it's your morning coffee or that unexpected splurge on Amazon, Minute Money records it all. You can manually enter your expenses or sync the app with your bank account for automatic updates. I found the categorization feature particularly helpful – it sorts expenses into neat little categories, so you can see where your money is going at a glance.

Budgeting Made Simple

Now, let's talk budgeting. Minute Money takes the dread out of budgeting with its user-friendly tools. Set your monthly budget, and the app keeps you updated on your spending habits. It even sends gentle reminders when you're nearing your limit, which, let's be honest, we all need sometimes. It's like having a financial advisor who doesn't charge by the hour!

Saving Goals and Achievements

One of my favorite features has to be the saving goals. You can set targets for anything – a new gadget, a vacation, or just a rainy day fund. Watching the progress bar fill up is oddly satisfying and motivates you to save more. And when you hit a milestone, the app rewards you with a little celebration on-screen. It's these small touches that make Minute Money not just an app, but a companion in your financial journey.

Security and Privacy

In the age of digital everything, security is a big deal. Minute Money doesn't skimp on safeguarding your data. With its bank-level encryption and biometric login options, you can rest easy knowing your financial information is well-protected. During my time with the app, I felt confident that my data was in safe hands.

Final Thoughts

All in all, Minute Money is a must-have for anyone looking to take control of their finances without the hassle of spreadsheets and complicated software. It's intuitive, reliable, and packed with features that cater to both newbies and seasoned financial planners. So, if you're ready to give your wallet a makeover, Minute Money might just be the app for you. Give it a go, and let me know how it transforms your financial life!

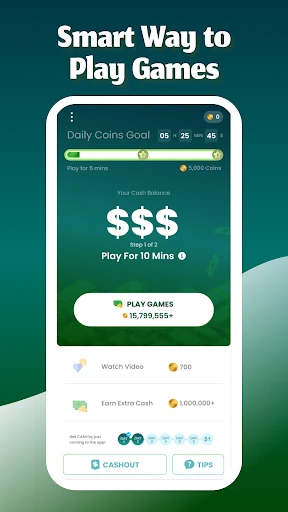

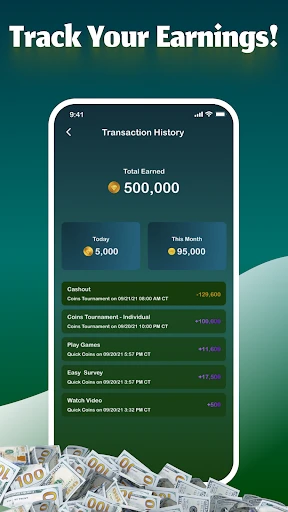

Screenshots