Klarna | Shop now. Pay later.

4.8 Shopping Updated January 7th, 2026

Oh, let me tell you about this fantastic app I stumbled upon recently called Klarna. You know how sometimes you just want to buy that gorgeous jacket or those sleek sneakers, but payday seems like light-years away? Well, Klarna has got your back, my friend. It's all about shopping now and paying later, making it a lifesaver for those of us who occasionally find ourselves a little short on cash.

Easy Shopping Experience

First things first, the app is super user-friendly. Navigating through it feels like a breeze. You can browse through endless categories and find just about anything your heart desires. From fashion to electronics, the app is packed with options. And the best part? You can split your payments into four interest-free installments. Yes, you heard that right! No interest, no hidden fees. It’s like having a shopping genie at your fingertips.

Seamless Checkout

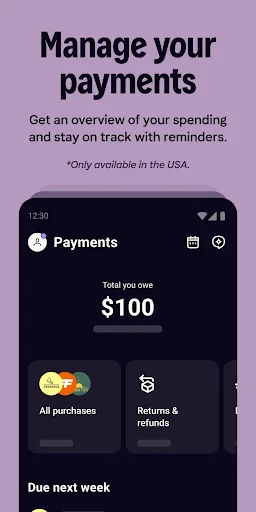

Another thing I absolutely love about Klarna is its seamless checkout process. You just add your items to the cart, select Klarna as your payment option, and voila! You’re good to go. The app even gives you reminders about upcoming payments, so you never miss a beat. It’s like having a personal shopping assistant who knows exactly when you need a nudge.

Security and Trust

Now, I know what you might be thinking. Is it safe? I had the same thought. But rest assured, Klarna takes security seriously. Your payment information is protected with top-notch encryption. Plus, they have a buyer protection policy so you can shop with peace of mind. It’s all about building trust, and Klarna nails it.

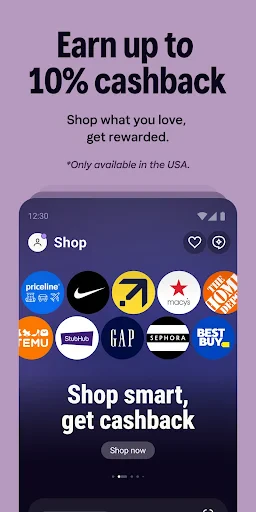

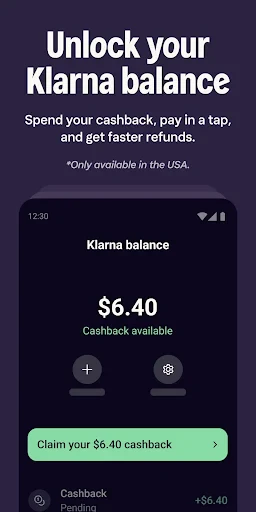

And for all the shopaholics out there, Klarna offers exclusive deals and discounts when you shop through the app. It’s like they’re rewarding you for indulging in retail therapy. How cool is that?

Final Thoughts

In conclusion, if you’re looking for a flexible way to manage your purchases without the stress of immediate payments, Klarna is definitely worth checking out. It’s perfect for those spontaneous shopping sprees or when that limited edition item catches your eye. Just remember to keep track of your spending, and you’ll be golden.

So, next time you’re eyeing that must-have item but your wallet’s feeling a bit light, give Klarna a whirl. It might just become your new shopping BFF. Happy shopping!

Screenshots