Ever wondered how to teach kids about money management in a fun and interactive way? That's where Greenlight Kids & Teen Banking comes into play. This app has been making waves among parents and educators alike, offering a platform to guide youngsters in understanding the value of money, savings, and spending wisely.

Getting Started with Greenlight

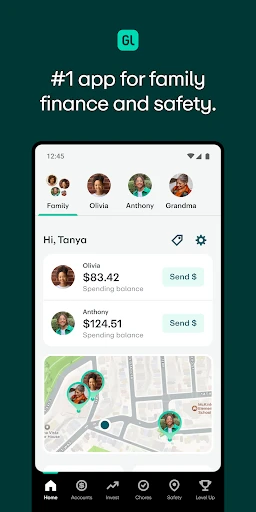

Upon downloading Greenlight Kids & Teen Banking, I was greeted with a user-friendly interface that’s both intuitive and engaging. Setting up an account was a breeze, requiring just a few basic details. What really caught my attention was the app’s seamless integration with both Android and iOS platforms, meaning you can access it from almost any device.

Features that Stand Out

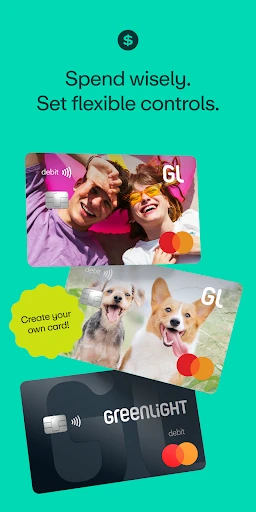

The app isn’t just about keeping track of money; it’s a comprehensive financial education tool. One of the features I found particularly useful is the customizable debit card for kids. This isn’t just any card; parents can set spending limits, monitor transactions in real-time, and even turn off the card with a simple tap. It’s like having a financial safety net at your fingertips!

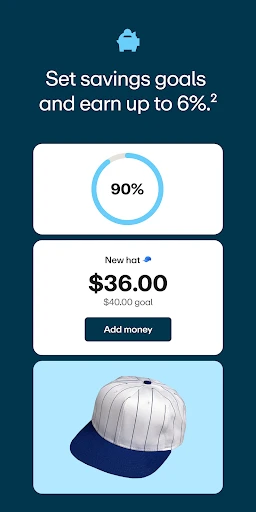

Another standout feature is the savings goal tracker. Kids can set their own goals, whether it's saving for a new gadget or stashing away for a future trip. Watching progress in real-time provides a tangible sense of achievement, which I think is a fantastic motivator.

The Educational Edge

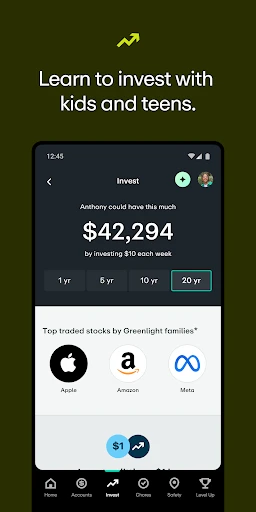

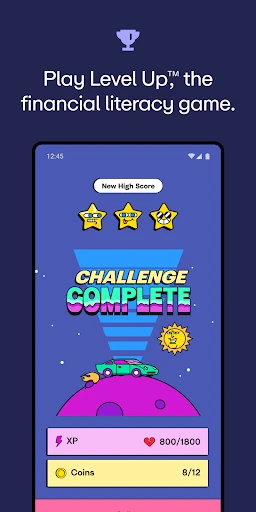

Education is at the core of Greenlight's mission. The app includes educational modules that teach kids about interest rates, investing, and the power of compounding. I found this aspect particularly impressive because it introduces complex financial concepts in a simplified manner that’s easy for kids to grasp.

Moreover, the app encourages discussions about money within the family. Parents can assign chores and set allowances directly through the app, turning everyday tasks into learning opportunities. This not only helps kids earn money but also understand the effort required to earn a dollar.

Why Parents Love It

As a parent, what’s not to love about an app that offers peace of mind while teaching valuable life skills? The parental controls are robust, ensuring that kids learn in a safe, controlled environment. Plus, the app’s customer support is top-notch, always ready to assist with any queries or technical issues.

In conclusion, Greenlight Kids & Teen Banking is more than just a banking app; it’s a gateway to financial literacy for the younger generation. It combines practicality with education, making money management an approachable and enjoyable topic for kids. If you’re looking to instill financial wisdom in your children, this app is definitely worth considering.